ADVISOR NEWS INSIGHT |

|

| |

Industry News |

|

Annuity Planning |

|

|

7 Annuity Exclusion Ratio Basics to Know One way for a financial advisor to get attention is to find a compliance-compatible way to post a guide to annuity exclusion ratio basics. The annuity exclusion ratio is an Internal Revenue Code provision that can reduce the federal income taxes on the cash coming out of a client’s annuity sharply. It can also help a financial advisor who believes that an annuity is a good option for a client to respond to the criticism that annuities saddle their owners with big tax bills. Here are seven basic things to know about how the exclusion ratio applies to simple situations involving fixed annuities that your client purchased, rather than inherited. (Allison Bell, Insurance Editor, ThinkAdvisor, 07/27/2023) |

|

Elder Planning |

|

|

AARP Report Finds $28.3 Billion a Year is Stolen from U.S. Adults Over 60 Older Americans lose an estimated $28.3 billion annually to elder financial exploitation (EFE), according to a new report from AARP. The report also shows that 87.5% of adults age 60 and older who are victimized by someone they know never report these incidents to authorities. In contrast, just one-third of victims of stranger-perpetrated EFE do not report it. (AARP, 06/15/2023) |

|

|

Deputizing Financial Institutions to Fight Elder Abuse Financial professionals have helped slow the growth of elder financial fraud thanks to provisions introduced by the 2016 Model Act, according to recently published research in the Journal of Financial Economics. Elder financial fraud has increased exponentially in recent years. In 2022, 88,262 victims over age 60 reported being defrauded, according to the FBI’s Internet Crime Complaint Center. Among the victims, reported losses totaled $3.1 billion, an 84% increase from the year prior. (Nathan Place, Retirement Reporter, Financial Planning, 07/26/2023) |

|

|

FBI Elder Fraud Report 2022 The Federal Bureau of Investigation’s (FBI) Internet Crime Complaint Center (IC3) is a central intake point for victims to report fraud. IC3 shares the complaints it receives with FBI field offices and other law enforcement and regulatory agencies for further investigation or action, as appropriate. Along with the Department of Justice’s Elder Fraud Initiative and other partners, the FBI is continually dedicated to identifying the perpetrators of these schemes and bringing them to justice. (FBI / IC3, 2022) |

|

Estate Planning |

|

|

Predicting Basic Exclusion Amount and Annual Gift Tax for 2024 On January 1 of each year, the estate and gift tax ‘basic exclusion amount,’ currently $12,920,000 per person, is adjusted for inflation. The 2024 inflation adjustment, which will be based on data gathered through August 31 of this year, will be announced this fall. But because the inflation adjustment incorporates data going back to September 2021, it is possible to project the 2024 inflation adjustment now with some precision. The adjustment will be approximately $740,000. The size of the 2025 inflation adjustment will depend on the course of inflation over the next year, but $500,000 is a reasonable guess based on currently available data and the continued inflationary pressures in the American economy. The gift tax annual exclusion will jump to $18,000 in 2024 and will likely reach $19,000 in 2025. (Peter Tucci, Associate, Proskauer (Private Client Services Department), 07/26/2023) |

|

IRA Planning |

|

|

DOL Abandons ERISA Fiduciary Rollover Guidance Appeal On May 18, 2023, the United States Department of Labor (the “DOL”) withdrew its appeal of a recent decision by the U.S. District Court for the Middle District of Florida that vacated a portion of the DOL’s 2021 guidance regarding individual retirement account (“IRA”) rollover recommendations to participants in retirement plans subject to the United States Employee Retirement Income Security Act of 1974, as amended (“ERISA”). The DOL’s decision to withdraw the appeal may provide a temporary reprieve from ERISA fiduciary status for investment advisers seeking to provide one-time rollover advice to ERISA plan participants. (Alexander P. Ryan, Partner, Executive Compensation & Employee Benefits, and John Rupp, Associate, Asset Management, Willkie Farr & Gallagher LLP, 05/23/2023) |

|

|

IRS Notice 2023-54 RMD Relief IRS releases Notice 2023-54 that excuses required minimum distributions (RMDs) for non-eligible designated beneficiaries (NEDBs) subject to the 10-year rule who inherited an IRA or qualified retirement plan in 2022. In addition the IRS said it would extend the 60-day rollover deadline for IRA (and plan) account accounts born in 1951 who received distributions in 2023 that weren’t necessary because of the SECURE 2.0 change that delayed their first RMD year from 2023 to 2024. (IRS, 2023) |

|

|

Q & As on Recent IRS RMD Relief This article addresses several questions about the recent IRS Notice 2023-54. (Ian Berger, JD, IRA Analyst, Ed Slott and Company, LLC, 07/26/2023) |

|

Medicare Planning |

|

|

CMS Finalizes New Medicare Marketing Rules The U.S. Centers for Medicare and Medicaid Services (CMS) issued a final rule on April 5, 2023, revising the regulations governing marketing by Medicare Advantage plans (MAPs) and Medicare Part D plans (PDPs). These changes follow CMS’s October 2022 memo expressing concern regarding MAP and PDP marketing practices, and the proposed rule issued on December 14, 2022. The changes are applicable for all contract year 2024 marketing and communications beginning September 30, 2023. (Sidley Austin LLP, 04/12/2023) |

|

Retirement Planning |

|

|

Bank of America’s 2023 Financial Life Benefits Impact Report The gender savings gap is closing among younger retirement investors, according to a recent study from Bank of America Corporation (BofA). On average, men’s 401(k) account balances exceeded women’s by 50%, while for Millennial (ages 28-42) men and woman, the gap was significantly less at 23%. (Don Vecchiarello, SVP, Media Relations Executive, BofA, 06/28/2023) |

|

|

IRS Defers Proposed Regulation RMD Requirements by at Least One Year, Provides Temporary rollover Relief to Those Born in 1951 The IRS on July 14, 2023 released multiple announcements concerning required minimum distributions (RMDs), including relief concerning RMDs and rollovers in accordance with Section 107 of SECURE 2.0. In IRS Notice 2022-53, the IRS stipulated that the minimum distribution rules for defined contribution plan balances (including IRAs) inherited from a beneficiary who had passed away after their required beginning date — as outlined in the proposed regulations under the SECURE Act — would not take effect until 2023 at the earliest. However, with the release of Notice 2023-54, [1] the IRS has further delayed the implementation of these rules by at least one year, meaning they will not be applicable until 2024 at the earliest. (John Iekel, Senior Writer/Editor, American Retirement Association, 07/14/2023) |

|

|

Retirement Could B A “Nightmare” For Generation X Just a few years away from retirement, many Gen Xers have very little — and sometimes nothing — saved for their post-work years, according to a new study. An analysis from the National Institute on Retirement Security (NIRS) found the typical Gen X household has just $40,000 in retirement savings in private accounts. Only about half — 55% — of Gen Xers are participating in an employer-sponsored retirement plan. (Editorial Staff, 401(k) Specialist, 07/14/2023) |

|

Social Security Planning |

|

|

What Will the Social Security COLA Raise Be for 2024? The Social Security Administration uses the percentage changes of the consumer price index during the third quarter from one year to the next when calculating the upcoming COLA. The consumer price index for June 2023 came in at 3%, according to the U.S. Bureau of Labor Statistics. The rate indicates that, on average, the items indexed rose in price by 3% during the previous 12 months. It was the smallest increase since the period ending in March 2021. Overall inflation in 2023 has been lower than in 2022, which saw 40-year highs such as 9.1% in June of that year. (Rachel Hartman, Contributor, U.S. News, 07/24/2023) |

|

Practice Management |

|

|

Top 7 Reasons Americans Hire Financial Advisors Two-thirds of American adults in a Northwestern Mutual study released Monday acknowledged that their financial planning needs improvement, including 79% of both Generation Z and Millennials. Respondents said having a financial advisor bolsters confidence, yet only 37% work with one. (Northwestern Mutual Life Insurance Company, 2023) |

|

|

How To Stop Saying “Um,” “Ah,” and “You Know” When you get rattled while speaking — whether you’re nervous, distracted, or at a loss for what comes next — it’s easy to lean on filler words, such as “um,” “ah,” or “you know.” These words can become crutches that diminish our credibility and distract from our message. (Noah Zandan, CEO and Co-Founder, Quantified Communications, 08/01/2018) |

|

|

The Art of the Elevator Speech So, what do you do? (Carmine Gallo, Harvard University Instructor, Keynote Speaker, and Author, 10/03/2018) |

|

Assumed Federal Rates (AFRs) |

|

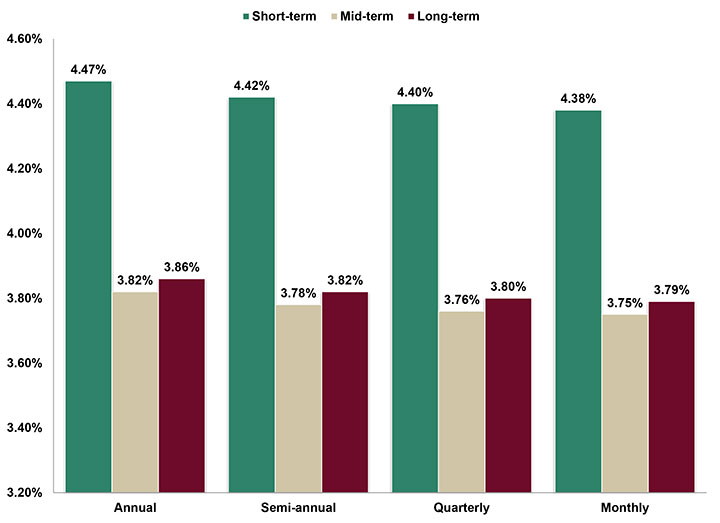

§7520 Rate for August is: 5.0% |

|

|

|

|

|

Advisor Tools |

|

2023 Tax & Social Security / Medicare Guides |

|

|

Our Federal Income Tax Guide is a comprehensive resource for staying up-to-date on tax rates and regulations. Our Social Security & Medicare Reference Guide is a comprehensive resource for Social Security and Medicare information. |

|

Financial / Insurance Calculators & Websites |

|

|

Explore our extensive list of online calculators and informational websites related to finance and insurance. These resources can help you with financial planning, retirement calculations, investment analysis, insurance needs assessment, and more. |

|

|

|

State Requirement Updates |

|

|

Stay up-to-date on CE requirements in your state by checking out our State Requirements page. |

|

|

|

Featured Course |

|

Estate Planning |

|

and regulations that affect many if not all their clients, their spouses, and dependents. |

|

|

|

B.E.S.T. CE Online |

|

Take our online courses at your own pace and at a price that won’t hurt your wallet. |

|

|

As a nationally approved provider by the State Insurance and CFP / IWI Boards, we offer courses that cover a wide range of topics relevant to your practice. Enroll in our online CE courses and reap the benefits of:

Start learning today! Click on the button below to learn more about our online CE courses. |

|

|

|

Disclaimer |

|

|

Unauthorized reproductions of Advisor News Insight newsletter is prohibited. However, you may forward this copy (in its entirety) to colleagues via email. This newsletter may not be posted on any website without written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.). The newsletter is a compilation of information published by various web-based sources, and B.E.S.T. does not claim authorship of the material unless otherwise stated. The articles are copyrighted to their respective publishers. While we have tested all links to ensure their functionality, we cannot guarantee their continued operation, as publishers may move or delete content. B.E.S.T. does not endorse and disclaims any and all responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed in this newsletter are solely those of the author and do not necessarily reflect the positions of B.E.S.T. Readers should rely on the information contained herein ONLY AFTER conducting an independent review of its accuracy, completeness, efficacy, and timeliness. THIS NEWSLETTER IS FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSTITUTE INVESTMENT, TAX, ACCOUNTING, OR LEGAL ADVICE. |

|

B.E.S.T. Information / Services |

|

Learn More |

|

Resources |

|

|

Click the button below to access our comprehensive suite of resources, including calculators, websites, tax and Social Security and Medicare quick-reference guides, monthly newsletters and recorded webinars. |

|

Social Media |

|

Physical Address & Hours of Operation |

|

|

© 1986 - 2023 Broker Educational Sales & Training, Inc. All Rights Reserved.

|

|

Miscellaneous |

|

|

* Unsubscribe / remove me from your mailing list. Please allow up to five (5) business days for removal. |

|

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

|