Advisor News Insight |

||

|

News • AFRs • Facts • Website • Recommended • Podcast • Tools • Requirements • Featured • CE |

||

|

||

Industry News |

||

Estate Planning |

||

Fragmented WillsA will typically is a single document that is prepared by a testator at one time. Not all wills are typical, though. A will can comprise multiple documents that are prepared at different times during the testator’s life. This scenario occurs when a testator executes an initial will and then later executes one or more codicils that amend rather than replace the initial will. In this scenario, multiple documents must be collected at the testator’s death and construed together to obtain a full understanding of the testator’s intended estate plan. This Article refers to these atypical wills, which express the testator’s intent across multiple documents, as fragmented wills. (Mark Glover, Professor of Law, University of South Carolina School of Law, 04/25/2024) |

||

Life Insurance Planning |

||

Limited-Pay Options for Lifetime CoverageLimited-pay life insurance is an appealing proposition to many clients. With today’s flexible products, there are multiple ways to achieve a limited-pay solution. (Kathleen Johnson, CLU, FLMI, ACS, Regional Vice President, Mutual Trust Life Solutions (Northeast Region), 07/17/2024) |

||

Retirement Planning |

||

EBRI: Americans’ Retirement Confidence Shows Slight ImprovementsWhile workers’ and retirees’ confidence in achieving a financially comfortable retirement has not fully recovered from a significant drop seen in 2023, the Employee Benefits Research Institute (EBRI) found positive signs that confidence is recovering. According to EBRI’s recent study, 2024 Retirement Confidence Survey, 68% of workers and 74% of retirees are confident they will have enough money to live comfortably throughout retirement. However, this is not a significant increase from last year, when the figures were 64% for workers and 73% for retirees. (EBRI, 04/25/2024) |

||

How Long You May Live is One of Retirement Planning’s Biggest Unknowns. How Experts Say to Get the Best EstimateTo effectively plan for your retirement, experts say, you need to watch your savings rate and total nest egg. (Lorie Konish, Personal Finance Reporter, CNBC.com, 06/30/2024) Longevity Calculator The Society of Actuaries and American Academy of Actuaries recently relaunched a free online longevity illustrator. |

||

Required Minimum DistributionsOn July 18, 2024, the IRS issued final regulations updating the required minimum distribution (RMD) rules. The final regulations reflect changes made by the SECURE Act and the SECURE 2.0 Act impacting retirement plan participants, IRA owners and their beneficiaries. At the same time, Treasury and IRS issued proposed regulations, addressing additional RMD issues under the SECURE 2.0 Act. (IRS, 07/19/2024) |

||

Texas Court Stays DOL Fiduciary RuleA Texas judge today issued a preliminary injunction to freeze the Department of Labor Retirement Security Rule, its latest attempt to expand fiduciary duty to insurance agents. The ruling reads as follows:

|

||

Tax Planning |

||

Crypto Currency Tax ReportingTreasury and the IRA have issues final regulations regarding information reporting and the determination of amount realized and basis for certain digital asset sales and exchanges. (Robert S. Keebler, CPA/PFS, MST, AEP (Distinguished), CGMA, Partner, Keebler & Associates, LLP, 06/28/2024) |

||

Wealth Planning |

||

The Latest Personal Finance News for July 2024Here’s the latest personal finance news, how it may impact your financial plan and what you can do to maintain your financial well-being. (Ben Luthi, Freelance Writer, 07/01/2024) |

||

Practice Management |

||

2024 RIA Survey & Ranking: RIAs Confront Their Own SuccessPerhaps one should avoid the temptation to use house metaphors when describing something like an RIA business. And yet. (Eric Rasmussen, Financial Advisor, Journalist, 07/12/2024) |

||

Wirehouse Veteran Sees Risk to Clients in RIA ‘Behemoths’Few would argue that the RIA space doesn’t have a rosy future. But excessive inorganic growth through mergers and acquisitions might soon trigger problems for investors. (Jane Wollman Rusoff, Contributing Editor, ThinkAdvisor, 07/22/2024) |

||

Assumed Federal Rates (AFRs) |

||

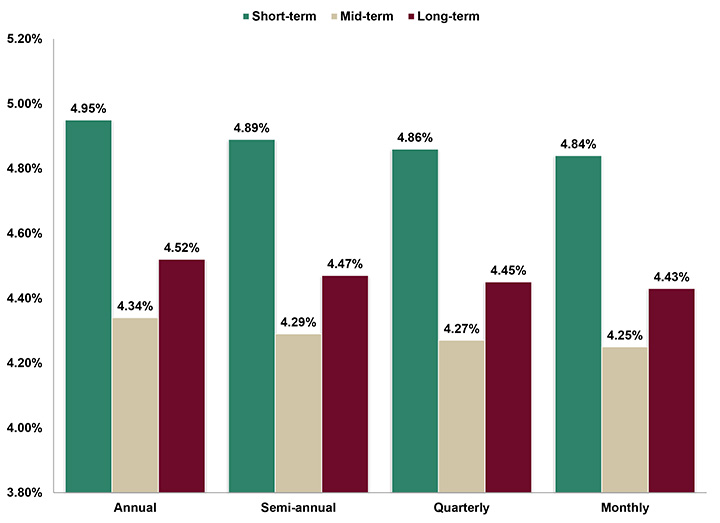

§7520 Rate for August is: 5.20% |

||

|

||

Financial Facts of the Month |

||

Cost of Living Facts and Statistics 2024Cost of living statistics 2024Inflation is slowing, but some key household essentials are still seeing elevated price increases. Multiple recent Bankrate surveys also confirm the sentiment that, despite what the overall numbers suggest, budgets remain strained: Key Takeaways

Source: bankrate.com |

||

Useful Financial Website |

||

Actuaries Longevity IllustratorWelcome to the Actuaries Longevity IllustratorThere is a significant chance that you will live for many years beyond the average, and you should consider this possibility when thinking about your retirement. The Actuaries Longevity Illustrator (“ALI”) has been developed as an educational tool by the American Academy of Actuaries and the Society of Actuaries to help you gauge what those chances are. |

||

Recommended Reading |

||

|

||

Recommended Podcast |

||

Retirement Income Strategy SmackdownHost Michael Finke, PhD, CFP®In this episode recorded on the floor of AICPA Engage 2024, host Michael Finke, PhD, CFP® welcomes fellow College professor and former podcast co-host David Blanchett, PhD, MSFS, CFA, CLU®, ChFC®, CFP® to the hot seat for a discussion on one of their favorite topics: comparing what's good and bad about various retirement income planning strategies. Listen as they explore the differences between fixed and flexible approaches, and the best ways to address risks. Find all episodes at TheAmericanCollege.edu/Shares. |

||

Advisor Tools |

||

Free 2024 Federal Income Tax and

|

||

Financial / Insurance Calculators & WebsitesDiscover a wealth of online calculators and informational websites tailored to your needs. Our extensive resources cover essential areas such as financial planning, retirement calculations, investment analysis, and insurance needs assessment, empowering you to provide comprehensive guidance and services to your clients. |

||

State Requirement Updates |

||

Stay Up-to-Date on Your

|

||

Featured Course |

||

IAR CE Credits |

||

B.E.S.T. CE Programs |

||

Take Our Online or Self-Study Courses at

|

||

|

As a nationally approved provider by the State Insurance, CFP®, IWI, and IAR Boards, we offer courses that cover a wide range of topics relevant to your practice. Enroll in our online or self-study CE courses and reap the benefits of:

Start learning today! Click on the button below to learn more about our online or self-study CE courses. Note: California, Florida and Texas are the only states available for online CE courses. |

||

Meet Your 2-hour CFP® Ethics RequirementAlso approved for 2 CE credit hours of IWI (CIMA®/CPWA®/RMA®) and IAR Ethics. Date: Thursday, August 22, 2024 | Time: 2:00PM - 4:00PM ET | Cost: See below* 2-hour live webinar presentation: Ethic CE CFP Boards Revised Code and Standards Ethics for CFP Professionals (Course#: 277681) - No exam required. This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. It is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct. This webinar presentation does NOT include state insurance CE credit. *Cost per license type:

Registering involves

three individual web pages and you will either be

automatically directed Registering includes the following three web pages:

NOTE: Do not close any of your web pages / browsers |

||

Start Fulfilling Your 12-hour IAR

|

||

|

CFP®: This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements. IWI: Investments & Wealth Institute® (IWI) has accepted this CFP® Ethics webinar for 2 hours of CE credit towards the IWI certifications. (CIMA®, CPWA® and RMA®) NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

||

Disclaimer |

||

|

Unauthorized reproductions of Advisor News Insight newsletter are strictly prohibited. However, you are permitted to forward this newsletter (in its entirety) to colleagues via email. Under no circumstances should this newsletter be posted on any website without prior written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.). Please note that this newsletter comprises information gathered from various web-based sources, and B.E.S.T. does not assert authorship of the material unless explicitly mentioned. The articles contained herein are copyrighted by their respective publishers. While we have taken measures to verify the functionality of all included links, we cannot guarantee their continuous operation, as publishers may relocate or remove content. It is important to understand that B.E.S.T. neither endorses nor assumes any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed within this newsletter belong solely to the author and do not necessarily represent the viewpoints of B.E.S.T. Readers are strongly encouraged to rely on the information provided herein ONLY AFTER conducting their independent review of its accuracy, completeness, effectiveness, and timeliness. THIS NEWSLETTER SERVES SOLELY FOR INFORMATIONAL PURPOSES AND DOES NOT CONSTITUTE INVESTMENT, TAX, ACCOUNTING, OR LEGAL ADVICE. |

||

B.E.S.T. Information / Services |

||

B.E.S.T. CE |

||

ResourcesAccess a robust suite of resources at your fingertips, encompassing calculators, informative websites, quick-reference guides for taxes, Social Security, and Medicare, as well as monthly newsletters and recorded webinars. Gain a wealth of knowledge and stay up-to-date with ease through our comprehensive offerings. |

||

Social Media |

||

|

||

Physical Address & Hours of Operation© 1986 - 2024 Broker

Educational Sales & Training, Inc. All Rights Reserved.

|

||

MiscellaneousAbout Us | Contact Us | Privacy Notice | Refund Policy | Unsubscribe* |

||

|

*Remove from mailing list. Please allow up to five (5) business days for removal. |

||

|

Ensure newsletter delivery to your inbox by adding newsletter-owner@best-ce.com to your address book. |

||