ADVISOR NEWS INSIGHT |

|||

| |||

Merry Christmas & Happy Holidays

|

|||

Industry News |

|||

NEW 2024 Federal Income Tax and

|

|||

|

Our Federal Income Tax Guide is a comprehensive resource for staying up-to-date on tax rates and regulations. Our Social Security & Medicare Reference Guide is a comprehensive resource for Social Security and Medicare information. (No personal or business emails required for download.) |

|||

Long-Term Care Planning |

|||

|

Long-Term Care Insurance Covers Over 7 Million People Nationwide, New AHIP Report Finds AHIP’s new report on long-term care insurance coverage highlights the important role long-term care insurance plans play across the country. Every American deserves to age with grace and dignity on their terms. That’s why long-term care insurance empowers people and their families with the freedom and flexibility to choose the care that works best for them. (AHIP, 11/07/2023) |

|||

Retirement Planning |

|||

|

9 Things You Should Know About Retirement Portfolios: Vanguard Plan Sponsor provides nine important insights about the income planning and portfolio management process for income-focused retirees. Armed with this information, clients (and their advisors) will be primed for more effective discussions about the right approach to the “decumulation challenge.” (John Manganaro, Senior Reporter, ThinkAdvisor, 11/15/2023) |

|||

|

Proposed Retirement Security Rule: Definition of an Investment Advice Fiduciary The Department of Labor’s Employee Benefits Security Administration is proposing a new rule that would protect workers’ retirement savings by updating the regulation defining a fiduciary under the Employee Retirement Income Security Act (ERISA). The “Retirement Security Rule: Definition of an Investment Advice Fiduciary” would affect how investors get advice on their job-based retirement accounts and other retirement savings plans and how investment advice providers must act if they have a conflict of interest. (U.S. Department of Labor, 10/31/2023) |

|||

|

Six Retirement Withdrawal Strategies that Stretch Savings - What’s the safe retirement withdrawal rate in 2023? For many investors, 4% sounds like the magic retirement withdrawal rate. Our research suggests the same, but fluctuating market valuations and rising inflation could threaten the security of retirement plans. In the State of Retirement Income, Morningstar researchers modeled the safe retirement drawdown rate for 2023. The report compares six retirement withdrawal strategies that can extend an investor’s retirement income. With data-driven plans, financial advisors can help clients feel secure and comfortable in the next stage of their financial lives. (Morningstar, 2023) |

|||

|

The New Fiduciary Rule (2): The Impact The Department of Labor (DOL) has released its package of proposed changes to the regulation defining fiduciary advice and to the exemptions for conflicts and compensation for investment advice to plans, participants (including rollovers), and IRAs. This post discusses the likely impact of the new proposals. Future posts will go into more detail about the proposals and compliance issues. (C. Frederick Reish, Partner, Faegre Drinker’s Benefits & Executive Compensation practice group, 11/08/2023) |

|||

|

Why Do Late Boomers Have So Little Wealth And How Will Early Gen-Xers Fare? Due to changes in the retirement landscape in recent decades, Late Boomers (who are now nearing retirement) would be expected to have less wealth from traditional pensions, Social Security, and housing, but higher 401(k)/IRA assets compared to Mid Boomers at the same age. Strikingly, though, Late Boomers have seen a drop in their 401(k)/IRA assets. The questions are why is their 401(k)/IRA wealth lower and what do the patterns mean for younger cohorts. (Several authors, Center for Retirement Research at Boston College, 05/2023) |

|||

Social Security Planning |

|||

|

Lifetime Social Security Benefits and Taxes: 2023 Update The Congressional Budget Office and government actuaries for decades have shown that Social Security and Medicare remain on unsustainable tracks, but it is often hard to visualize how $100 billion here or $1 trillion there translates in a country with national income of more than $25 trillion. A new report on lifetime income Social Security and Medicare benefits and taxes provides a different and useful vantage point. This report focuses on how much hypothetical workers receive in lifetime benefits compared to how much they pay in taxes that help fund these programs. For a single male earning an average wage every year and who retired in 2020 at age 65, lifetime Social Security and Medicare benefits would equal about $640,000, while total taxes paid would be just shy of $470,000. For a couple with one average earner and one low-wage earner, benefits would total about $1.24 million, while taxes would reach $680,000. Those amounts rise and fall for other hypothetical households as their incomes rise and fall relative to average wages. (C. Eugene Steuerle, Institute Fellow and Richard B. Fisher Chair, and Karen E. Smith, Senior Fellow, Tax Policy Center, Urban Institute & Brookings Institution, 11/13/2023) |

|||

Tax Planning |

|||

|

IRS Posts Tax Inflation Adjustments for 2024 The Internal Revenue Service announced inflation adjustments for more than 60 tax provisions for tax year 2024. Revenue Procedure 2023-34 sets out the tax year 2024 adjustments, which generally apply to tax returns filed in 2025. (IRS, 2024) |

|||

|

Year-End Charitable Giving and IRA Qualified Charitable Distributions As the 2023 tax year winds down, owners of individual retirement accounts (IRAs) might consider combining the 2023 tax benefits of charitable giving with a qualified charitable distribution (QCD) from their IRA. (Scott Cashman, Tax Manager, Bowditch & Dewey, 11/20/2023) |

|||

Practice Management |

|||

|

Optimizing Virtual Client Meetings To Make Them More “Real” and Less Exhausting In this post, Kitces Senior Financial Planning Nerd Ben Henry-Moreland writes about the unique challenges created by virtual meetings and how advisors can optimize their meeting space (as well as the structure of the meetings themselves) as a virtual environment. (Ben Henry-Moreland, Senior Financial Planning Nerd, Kitces.com, 11/13/2023) |

|||

|

SEC Announces Enforcement Results for 2023 The Securities and Exchange Commission today announced that it filed 784 total enforcement actions in fiscal year 2023, a 3 percent increase over fiscal year 2022, including 501 original, or “stand-alone,” enforcement actions, an 8 percent increase over the prior fiscal year. The SEC also filed 162 “follow-on” administrative proceedings seeking to bar or suspend individuals from certain functions in the securities markets based on criminal convictions, civil injunctions, or other orders and 121 actions against issuers who were allegedly delinquent in making required filings with the SEC. (U.S. Securities and Exchange Commission, 11/14/2023) |

|||

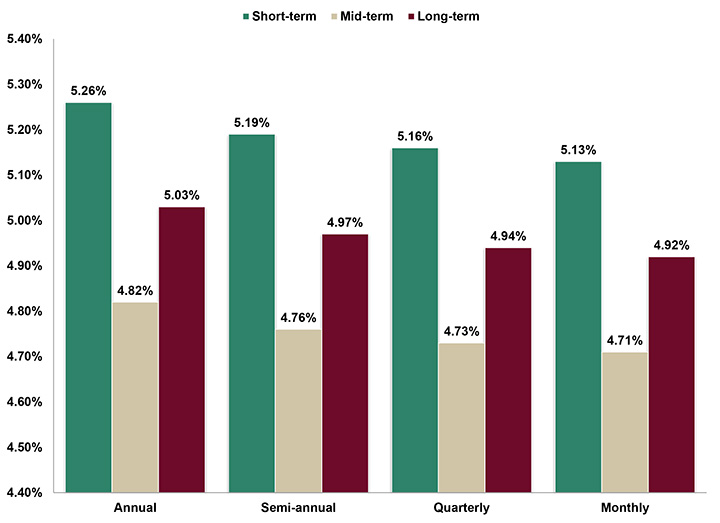

Assumed Federal Rates (AFRs) |

|||

§7520 Rate for December is: 5.80% |

|||

|

|||

|

|||

Advisor Tools |

|||

2024 Federal Income Tax and

|

|||

|

Our Federal Income Tax Guide is a comprehensive resource for staying up-to-date on tax rates and regulations. Our Social Security & Medicare Reference Guide is a comprehensive resource for Social Security and Medicare information. |

|||

Financial / Insurance

|

|||

|

Explore our extensive list of online calculators and informational websites related to finance and insurance. These resources can help you with financial planning, retirement calculations, investment analysis, insurance needs assessment, and more. |

|||

|

|||

State Requirement Updates |

|||

|

Stay up-to-date on CE requirements in your state by checking out our State Requirements page. |

|||

|

|||

Featured Course |

|||

The Advisors Guide to

|

|||

|

|||

|

|||

B.E.S.T. CE Programs |

|||

Take our online courses at your own pace and at a price that won’t hurt your wallet. |

|||

|

As a nationally approved provider by the State Insurance and CFP / IWI Boards, we offer courses that cover a wide range of topics relevant to your practice. Enroll in our online CE courses and reap the benefits of:

Start learning today! Click on the button below to learn more about our online CE courses. |

|||

|

|||

Live 2-hour CFP® Ethics CE Webinar |

|||

|

Thursday, December 14 | 2:00PM - 4:00PM ET | Costs: See below Live webinar presentation: Ethic CE CFP Boards Revised Code and Standards Ethics for CFP Professionals (Course#: 277681) - No exam required. This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. It is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct. This webinar presentation does NOT include state insurance CE credit. Cost per license type:

NOTE: Do

not close any of your web pages / browsers Registering involves the following three web pages:

|

|||

|

|||

|

CFP®: This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNERTM, CFP®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements. IWI: Investments & Wealth Institute® (IWI) has accepted this CFP® Ethics webinar for 2 hours of CE Ethics credit towards the IWI certifications. (CIMA®, CPWA® and RMA®) |

|||

Start Fulfilling Your 12-hour

|

|||

|

Small Business Retirement Plans and Ethical Practices (split course)* Course #1: C25279 | Course #2: C25280 | Cost: see below Small businesses constitute an essential element of the U.S. economy. Approximately 30 million small businesses operate in the United States, making up the vast majority of employer firms in the country. Collectively, these small businesses employ nearly 80 million workers or approximately half of all private sector employees. This course is designed to review and clarify the diverse business structures and the benefit plans available to each. For decades, the tax law has included special rules to provide various benefits or incentives to small businesses or to exclude them from a burdensome rule. Yet, the federal tax law has no single, uniform definition of small business. Instead, as recently illustrated by the Small Business Jobs Act of 2010, such businesses may be defined based on gross receipts, assets, capital, entity type, number of shareholders or some amount of outlay, such as start-up expenditures. Even with the same base, such as gross receipts, small is defined with varying dollar amounts. Section II of the course includes the definition of ethics, specific ethics in the insurance industry, its history and regulation, unfair marketing practices and navigating ethical dilemmas. Courses only available for states that have adopted the NASAA Model Regulations. |

|||

|

|||

|

Online course includes:

Cost per license type:

Above listed costs include the following fees:

|

|||

|

|||

|

Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

|||

Disclaimer |

|||

|

Unauthorized reproductions of Advisor News Insight newsletter is prohibited. However, you may forward this copy (in its entirety) to colleagues via email. This newsletter may not be posted on any website without written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.). The newsletter is a compilation of information published by various web-based sources, and B.E.S.T. does not claim authorship of the material unless otherwise stated. The articles are copyrighted to their respective publishers. While we have tested all links to ensure their functionality, we cannot guarantee their continued operation, as publishers may move or delete content. B.E.S.T. does not endorse and disclaims any and all responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed in this newsletter are solely those of the author and do not necessarily reflect the positions of B.E.S.T. Readers should rely on the information contained herein ONLY AFTER conducting an independent review of its accuracy, completeness, efficacy, and timeliness. THIS NEWSLETTER IS FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSTITUTE INVESTMENT, TAX, ACCOUNTING, OR LEGAL ADVICE. |

|||

B.E.S.T. Information / Services |

|||

Learn More |

|||

Resources |

|||

|

Click the button below to access our comprehensive suite of resources, including calculators, websites, tax and Social Security and Medicare quick-reference guides, monthly newsletters and recorded webinars. |

|||

Social Media |

|||

Physical Address & Hours of Operation |

|||

|

© 1986 - 2023 Broker Educational Sales & Training, Inc. All Rights Reserved.

|

|||

Miscellaneous |

|||

|

* Unsubscribe / remove me from your mailing list. Please allow up to five (5) business days for removal. |

|||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

|||