Advisor News Insight |

||

|

||

Industry News |

||

Retirement Planning |

||

|

Longevity Risk: An Essay A special report from the Center for Retirement Research at Boston College, reports some key findings that over the last century, life expectancy has increased significantly. This increase has underscored the need for efficient retirement planning. Nevertheless, a key difficulty when planning for retirement is that individuals do not know how long they will live. Hence, they need to account for the possibility of living longer than expected and exhausting their assets as a result (“longevity risk”). (Karolos Arapakis, Research Economist, and Gal Wettstein , Senior Research Economist, Center for Retirement Research at Boston College, 11/2023) |

||

|

Miscellaneous Changes Under the SECURE 2.0 Act of 2022 The IRS issued an 81-page question-and-answer notice (Notice 2024-2) related to several provisions of the SECURE 2.0 Act of 2022 that became law almost exactly a year ago. The document is titled “Miscellaneous Changes Under the SECURE 2.0 Act of 2022.” Specifically, this notice addresses issues under the following sections of the SECURE 2.0 Act (IRS, 12/20/2023):

|

||

|

New Report: Economic Fears Driving Retirees Back to Work This year, more Americans will turn 65 years old than at any point in history, with roughly 12,000 people a day reaching the age most target for retirement. A new survey from the Nationwide Retirement Institute® reveals that many adults in this age range are not as financially comfortable as they expected to be at this stage of life. (Nationwide, 1/22/2024) |

||

Annuity Planning |

||

|

Why Do Clients Really Ignore Advice on Annuities? A recent paper and summary brief published by two experts at the Center for Retirement Research at Boston College has sparked a debate about financial advisors being able to steer clients toward guaranteed income annuities in the retirement planning process. (John Manganaro, Senior Reporter, ThinkAdvisor, 1/17/2024) |

||

Elder Law Planning |

||

|

Top 10 Elder Law Decisions in 2023 The following is ElderLawAnswers’ annual roundup of the top 10 elder law decisions from the past year, as measured by the number of unique pageviews each case summary received. Decisions appear in chronological order. (ElderLawAnswers, for Attorneys, 2023) |

||

|

Key Elder Law Numbers for 2024: Annual Roundup ElderLawAnswers.com has gathered 2024 updates for attorneys on the following key elder law figures. (ElderLawAnswers, for Attorneys, 2024) Download our 2024 tax and/or reference guides below. Read more | Federal Income Tax Guide | Social Security & Medicare Reference Guide |

||

IRA Planning |

||

|

Outstanding Rollovers - What You Need to Know The rules for rolling over IRA distributions can be complicated. These rules can become especially challenging at the end of the calendar year. If you are taking a distribution from your IRA at end of 2023 and considering a rollover that may not be completed until 2024, here are four facts you will want to know. (Sarah Brenner, JD, Director of Retirement Education, Ed Slott and Company, LLC., 01/22/2024) |

||

Life Insurance Planning |

||

|

Life Sales Review: a 2023 Sales Dip Should Reverse in 2024, LIMRA Says LIMRA expects life insurance sales to increase 5% in both 2024 and 2025, reversing a dip in 2023, during which premium growth declined 3% in the first half of the year. LIMRA cites a strengthening economy and favorable regulatory environment as reasons for its positive outlook. (John Hilton, Senior Editor, InsuranceNewsNet, 12/28/2023) |

||

Social Security Planning |

||

|

Social Security Claiming Intentions: Psychological Ownership, Loss Aversion, and Information Displays For many Americans, the question of when to claim Social Security benefits is one of the most consequential financial decisions they will ever face. While acknowledging that individuals differ in terms of optimal timing for starting Social Security benefits, many economists argue that an average person would benefit from delaying claiming as long as they could. Yet this is not what average Americans do. Many more Americans claim as soon as possible, at age 62, rather than as late as possible, at age 70. Why? This paper focuses on individual differences in beliefs and values that influence Social Security claiming intentions. (Suzanne Shu, John S. Dyson Professor in Marketing and Dean of Faculty and Research, Cornell University and John W. Payne, Joseph R. Ruvane, Jr. Professor Emeritus, Duke University, 07/2023) |

||

|

The Psychology Behind Starting Social Security at 62 Social Security supplies a substantial share, and often the majority, of a retiree’s income. For these older workers delaying signing up for their benefits is often a smart strategy. |

||

Practice Management |

||

|

FINRA Releases 2024 Regulatory Oversight Report The Financial Industry Regulatory Authority (FINRA) recently released its 2024 Annual Regulatory Oversight Report, offering crucial insights into the regulatory landscape for broker-dealers. The report addresses various areas, emphasizing key priorities, risks, and effective practices for firms to remain aware of during the coming year. The following are the key takeaways from the 90-page release. (FINRA, 01/2024) |

||

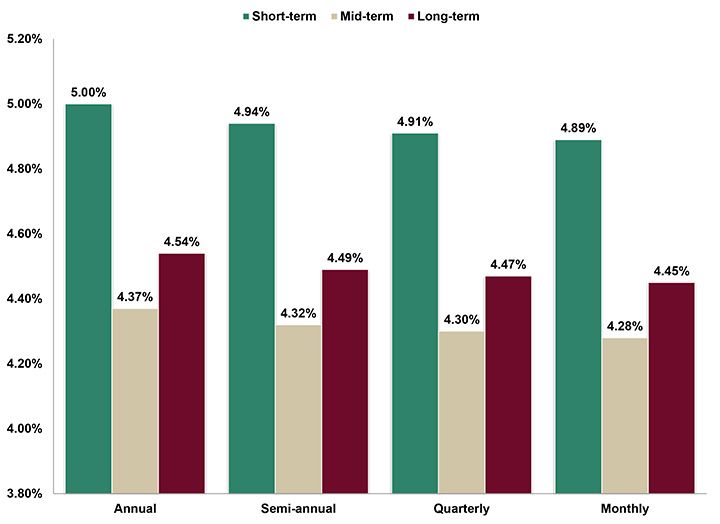

Assumed Federal Rates (AFRs) |

||

§7520 Rate for February is: 4.80% |

||

|

||

Advisor Tools |

||

Free 2024 Federal Income Tax and Social Security & Medicare Reference GuidesOur free Federal Income Tax and Social Security & Medicare Reference guides are indispensable resources. The Federal Income Tax Guide keeps you updated on tax rates and regulations, ensuring you provide your clients with the latest insights. Meanwhile, the Social Security & Medicare Reference Guide equips you with comprehensive information to navigate these critical topics, enhancing your advisory services and benefiting your clients’ financial well-being. (No business or personal information required for download.) |

||

Financial / Insurance Calculators & WebsitesA comprehensive list of online financial and insurance tools and information.Discover a wealth of online calculators and informational websites tailored to your needs. Our extensive resources cover essential areas such as financial planning, retirement calculations, investment analysis, and insurance needs assessment, empowering you to provide comprehensive guidance and services to your clients. |

||

State Requirement Updates |

||

Stay Up-to-Date on Your State Insurance CE requirementsEasily access vital information about state insurance license renewal dates, continuing education (CE) requirements, and more by visiting our State Requirements page. Stay informed and streamline your compliance process with this valuable resource. |

||

Featured Course |

||

Small Business Retirement Plans and Ethical Practices |

||

B.E.S.T. CE Programs |

||

Take Our Online Courses at Your Own Pace and Take Advantage of Affordable Prices |

||

|

As a nationally approved provider by the State Insurance and CFP / IWI Boards, we offer courses that cover a wide range of topics relevant to your practice. Enroll in our online CE courses and reap the benefits of:

Start learning today! Click on the button below to learn more about our online CE courses. |

||

Meet Your 2-hour CFP® Ethics RequirementAlso approved for 2 CE credit hours of IWI (CIMA®/CPWA®/RMA®) & IAR Ethics. Date: Thursday, February 15, 2024 | Time: 2:00PM - 4:00PM ET | Cost: See below* 2-hour live webinar presentation: Ethic CE CFP Boards Revised Code and Standards Ethics for CFP Professionals (Course#: 277681) - No exam required. This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. It is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct. This webinar presentation does NOT include state insurance CE credit. *Cost per license type:

Registering involves

three individual web pages and you will either be

automatically directed Registering includes the following three web pages:

NOTE: Do not close any of your web pages / browsers |

||

Start Fulfilling Your 12-hour IAR CE Requirements Online Today!Small Business Retirement Plans and Ethical Practices (split course)* Course #1: C25279 | Course #2: C25280 | Cost: see below Small businesses constitute an essential element of the U.S. economy. Approximately 30 million small businesses operate in the United States, making up the vast majority of employer firms in the country. Collectively, these small businesses employ nearly 80 million workers or approximately half of all private sector employees. This course is designed to review and clarify the diverse business structures and the benefit plans available to each. For decades, the tax law has included special rules to provide various benefits or incentives to small businesses or to exclude them from a burdensome rule. Yet, the federal tax law has no single, uniform definition of small business. Instead, as recently illustrated by the Small Business Jobs Act of 2010, such businesses may be defined based on gross receipts, assets, capital, entity type, number of shareholders or some amount of outlay, such as start-up expenditures. Even with the same base, such as gross receipts, small is defined with varying dollar amounts. Section II of this course includes the definition of ethics, specific ethics in the insurance industry, its history and regulation, unfair marketing practices and navigating ethical dilemmas. IAR CE credits are only available for states that have adopted the NASAA Model Regulations. |

||

|

Online course includes:

Cost per license type:

Above listed costs include the following fees:

|

||

|

CFP®: This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNERTM, CFP®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements. IWI: Investments & Wealth Institute® (IWI) has accepted this CFP® Ethics webinar for 2 hours of CE credit towards the IWI certifications. (CIMA®, CPWA® and RMA®) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

||

Disclaimer |

||

|

Unauthorized reproductions of Advisor News Insight newsletter are strictly prohibited. However, you are permitted to forward this newsletter (in its entirety) to colleagues via email. Under no circumstances should this newsletter be posted on any website without prior written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.). Please note that this newsletter comprises information gathered from various web-based sources, and B.E.S.T. does not assert authorship of the material unless explicitly mentioned. The articles contained herein are copyrighted by their respective publishers. While we have taken measures to verify the functionality of all included links, we cannot guarantee their continuous operation, as publishers may relocate or remove content. It is important to understand that B.E.S.T. neither endorses nor assumes any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed within this newsletter belong solely to the author and do not necessarily represent the viewpoints of B.E.S.T. Readers are strongly encouraged to rely on the information provided herein ONLY AFTER conducting their independent review of its accuracy, completeness, effectiveness, and timeliness. THIS NEWSLETTER SERVES SOLELY FOR INFORMATIONAL PURPOSES AND DOES NOT CONSTITUTE INVESTMENT, TAX, ACCOUNTING, OR LEGAL ADVICE. |

||

B.E.S.T. Information / Services |

||

Comprehensive List of Online Finance and Insurance Tools & Information |

||

ResourcesAccess a robust suite of resources at your fingertips, encompassing calculators, informative websites, quick-reference guides for taxes, Social Security, and Medicare, as well as monthly newsletters and recorded webinars. Gain a wealth of knowledge and stay up-to-date with ease through our comprehensive offerings. |

||

Social Media |

||

|

||

Physical Address & Hours of Operation© 1986 - 2024 Broker

Educational Sales & Training, Inc. All Rights Reserved.

|

||

MiscellaneousAbout Us | Contact Us | Privacy Notice | Refund Policy | Unsubscribe* |

||

|

* Unsubscribe (remove from mailing list(s)). Please allow up to five (5) business days for removal. |

||

|

Ensure newsletter delivery to your inbox by adding newsletter-owner@best-ce.com to your address book. |

||