Advisor News Insight |

||

|

News • AFRs • Web Links • Website • Tools • Requirements • Featured • CE |

||

|

As we step into the new year, we want to express our heartfelt appreciation to our valued clients for your unwavering support. We extend our warmest wishes for a joyful, healthy, and prosperous 2024! |

||

|

We’d also like to extend our gratitude for your continued readership of the B.E.S.T. monthly newsletter. Over the past 13 years, we’ve been privileged to share this valuable resource with over 65,000 financial and insurance professionals nationwide. The core mission of our newsletter is to equip you, the dedicated financial and insurance professional, with curated articles, white papers, posts, podcasts, web links, and books that I have personally reviewed. Our aim is to empower you in offering the most knowledgeable and professional services to your clients. We hope to have successfully achieved this goal and eagerly anticipate serving your needs in 2024. Once again, thank you for your trust, and may the new year bring you and your loved ones safety, happiness, health, and prosperity! Edward J. Barrett, CFP®, ChFC®, CLU®, CEBS®, RPA, CRPS®, CRPC® CPFA®, CEPA®, AIF®, Founder, President, and CEO. |

||

Industry News |

||

Meet Your IAR CE Requirements |

||

|

The end of the year is right around the corner and for the first time since the implementation of the IAR CE requirement there may be representatives whose registrations may be in jeopardy for failure to complete their IAR CE. If an IAR is two compliance periods in arrears, they will fail to renew and their official record will reflect “Terminated-No IAR CE.” IAR CE requirements must be maintained if an IAR has been registered with a state which requires IAR CE for any part of the year. This means if you dropped a registration mid-year with any state that has an IAR CE requirement in place, you are still required to complete IAR CE or risk being terminated for no IAR CE. If you find yourself in need of IAR CE courses to fulfill your requirements, we’re here to help! |

||

Annuity Planning |

||

|

Annuity Sales Review: 2023 was Great but 2024 Could be Even Better Sales of annuity products hit record highs throughout 2023 and ended the year riding a wave strong enough to raise expectations for 2024 and beyond. Favorable economic conditions is the biggest factor leading LIMRA to project strong growth for annuity sales going forward. Annuity sellers offer unique products to match differing economic trends. (John Hilton, Senior Editor, InsuranceNewsNet, 12/27/2023) |

||

Elder Abuse Planning |

||

|

States with the Best Elder-Abuse Protections (2024) Elder abuse is a complex and concerning issue that affects vulnerable older Americans in various ways and cost us more than $1.6 billion last year. It is important that we take action to address this issue and ensure that older Americans are protected and their dignity is preserved, especially as the older population grows. The U.S. Census Bureau predicts that the population aged 65 and older will almost double from 49.2 million in 2016 to 94.7 million in 2060. By taking action now, we can pave the way for a brighter and safer future for our older generations. WalletHub is raising awareness of this critical issue by comparing the 50 states and the District of Columbia based on 16 key indicators of elder abuse protection in 3 overall categories. Our data set ranges from the share of elder abuse, gross neglect and exploitation complaints to financial elder-abuse laws. (Katherine C. Pearson, Professor of Law, Penn State Dickinson Law, 12/13/2023) |

||

IRA Planning |

||

|

Congress Makes SIMPLE IRA Plans Less Simple Starting in 2024, both the under-50 limit and the catch-up limit will increase by 10% above the $16,000 / $3,500 limits – but only for businesses with 25 or fewer employees. So, for those very small companies, the 2024 under-50 limit is actually $17,600 ($16,000 x 10%), and the catch-up limit is $3,850 ($3,500 x 10%). And it gets worse. Businesses with 26-100 employees can elect the extra 10%, but only if they provide a 4% (instead of 3%) matching contribution or a 3% (instead of 2%) across-the-board contribution. (Ian Berger, JD, IRA Analyst, Ed Slott and Company, LLC, 12/6/2023) |

||

|

Retirement Assets in State Automated Savings Program Hit $1 Billion The Pew Charitable Trust reports that more than 800,000 savers are participating in states with programs up and running. Automated savings programs, intended to help private sector workers put earnings away for their retirement, hit a major milestone in November: Cumulative account assets across the seven state programs topped $1 billion. Since 2017, when Oregon launched a pilot for its Oregon Saves program, momentum has been building around automated savings for private sector workers who lack opportunities to save for retirement through their jobs. (Kim Olson, Senior Officer, Retirement Savings, The Pew Charitable Trusts, 12/22/2023) |

||

|

State Auto-IRA Assets Pass $1 Billion Milestone Cumulative assets across the first seven states to implement automated savings programs passed the $1 billion milestone in November and stood at $1.2 billion from 800,000 savers, as The Pew Charitable Trusts reported on Dec. 22. (Brian Anderson, Editor-in-Chief, 401(k) Specialist Magazine, 12/26/2023) |

||

Life Insurance Planning |

||

|

Advisors Look Ahead to Life Insurance in 2024 As 2023 draws to a close, agents and advisors are reviewing the trends that have impacted the life insurance industry during the past several months and are thinking about what is ahead for 2024. Although quite a few consumers see the value of owning life insurance, only 52% of U.S. adults report having life insurance coverage, either individual, group, or both. But 41% of American consumers say they need life insurance, or they need more life insurance. This represents more than 100 million adults. So, the need for life insurance is there. (Ayo Mseka, Freelance Reporter, 12/22/2023) |

||

Long-Term Care Planning |

||

|

Long-Term Care Coverage Stakeholder Thoughts on State-Based Catastrophic Insurance Long-term care (LTC) financing in the United States is a mix of public and private components that do not always align well for the American public. The disparate elements of LTC financing, from LTC insurance to informal family caregiving to Medicaid and other governmental programs, are not organized in a manner to keep up with the need to finance and provide care to our expanding aging population. These challenges are being exacerbated by the aging baby boom generation who will soon be coming to the ages when LTC needs are most prominent and affordable LTC solutions are lacking for many. (Society of Actuaries (SOA), 2/2023) |

||

Retirement Planning |

||

|

Americans Struggled with Retirement Planning in 2023 In a recent report for Kiplinger, the Society of Actuaries (SOA) Research Institute shared its takeaways on the growing challenges in preparing for retirement, noting that workers in 2023 faced more roadblocks to save for their long-term future. The cost of education while allocating for retirement has impeded on savings for many: A past SOA survey found that 63% say their ability to save for another’s college education has been impacted by needing to put money towards retirement. (Amanda Umpierrez, Managing Editor, 401(k) Specialist Magazine, 12/27/2023) |

||

Roth IRA Planning |

||

|

With Backdoor Roths, Is It Necessary to Zero Out IRA Accounts? Once tax-free basis is introduced to any of a taxpayer’s IRA accounts, all distributions will be characterized on a pro rata basis until such time that the Dec. 31 balance has zero taxable dollars. One method to accomplish a $0 balance would be for the taxpayer to withdraw and/or convert 100% of their IRA balances. Depending on the taxpayer’s situation, this could make sense. For financial advisors who are considering this strategy for their clients, we would recommend they start by contacting their clients’ tax preparer, sending them a copy of this article and the simple request: “I read this article, and it looked like it might make sense for our mutual client, Bob and Sue. Could I pay for an hour of your time to get your thoughts on this strategy in general and on our process for implementing it with clients?” (kitces.com, 12/26/2023) |

||

Social Security Planning |

||

|

Social Security Update: There’s a New Cutoff for Earnings – What It Means for Your Retirement Just because you collect Social Security benefits doesn’t mean you have to stop working. In fact, plenty of Social Security recipients still earn income from work – but for many, their benefits are reduced depending on their age and how much they earn. (Vance Cariaga, Free-lance Writer, Editor and Journalist, 11/5/2023) |

||

Tax Planning |

||

|

SECURE 2.0 Grab-Bag Brings Holiday Treats This holiday week, the IRS issued its long-anticipated guidance on miscellaneous changes under SECURE 2.0 Act of 2022 (“SECURE 2.0”) that are effective now (or in short order). Specifically, IRS Notice 2024-2, covers, in question-and-answer format, twelve provisions of SECURE 2.0. The guidance brings increased and much-needed clarity to several important provisions. (Groom Law Group, 12/22/2023) |

||

Wealth Planning |

||

|

Baby Boomers Over 70 Hold More Than 30% of Wealth in the US As a group, these older baby boomers have accumulated more than $14 trillion in additional net worth since the end 2019, based on Federal Reserve data. Their share of the country’s wealth has jumped to a record 30% last quarter, even though they account for 11% of the population. The aging population helps explain some the gains: There are about 2.3 million more people over 70 in the country than in 2019. (Alex Tanzi, Senior Editor: US Economy Team, Bloomberg L.P., 12/19/2023) |

||

Practice Management |

||

|

CFP Board Reminds Advisors of the Differences Between Fiduciary and Best Interest As more states rush to adopt best-interest annuity sales standards, the Certified Financial Planner Board of Standards is reminding advisors that it has a higher standard. The CFP Board’s Code of Ethics and Standards of Conduct takes precedence over the best-interest regulation created by the National Association of Insurance Commissioners. Forty-seven states have either adopted or are in discussions to adopt the NAIC best-interest model. The guidance points out five areas the code and standards differs from the NAIC best-interest model. (John Hilton, Senior Editor, InsuranceNewsNet, 12/14/2023) |

||

Assumed Federal Rates (AFRs) |

||

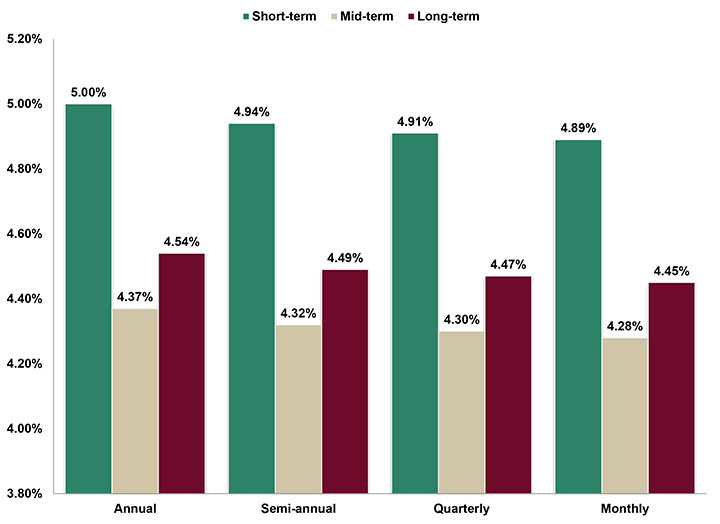

§7520 Rate for January is: 5.20% |

||

|

||

Informational Web Links |

||

2023 Retirement Confidence SurveyAnnual survey by Employee Benefits Research Institute (EBRI) and Greenwald Research finds that:

Download the Survey: ebri.org/docs/default-source/rcs/2023-rcs/2023-rcs-short-report.pdf |

||

Investment Company Institute (ICI) 2023 Fact BookAnnual review of trends and activities in the investment company industry, from the Investment Company Institute. May, 2023. PDF, 156 pp.May, 2023. PDF, 156 pp.: ici.org/system/files/2023-05/2023-factbook.pdf |

||

IRS Fiscal Year 2022 Data BookThe Internal Revenue Service’s annual Data Book details the agency’s activities during fiscal year 2022 (Oct. 1, 2021 – Sept. 30, 2022), including revenue collected and tax returns processed. April 14, 2023. Download the Book: irs.gov/newsroom/irs-releases-fiscal-year-2022-data-book-describing-agencys-activities |

||

Useful Financial Website |

||

Federal Reserve DataDFA: Distribution of Household Wealth in the U.S. since 1989.

|

||

Advisor Tools |

||

Free 2024 Federal Income Tax and Social Security & Medicare Reference GuidesOur free Federal Income Tax and Social Security & Medicare Reference guides are indispensable resources. The Federal Income Tax Guide keeps you updated on tax rates and regulations, ensuring you provide your clients with the latest insights. Meanwhile, the Social Security & Medicare Reference Guide equips you with comprehensive information to navigate these critical topics, enhancing your advisory services and benefiting your clients’ financial well-being. (No business or personal information required for download.) |

||

Financial / Insurance Calculators & WebsitesA comprehensive list of online financial and insurance tools and information.Discover a wealth of online calculators and informational websites tailored to your needs. Our extensive resources cover essential areas such as financial planning, retirement calculations, investment analysis, and insurance needs assessment, empowering you to provide comprehensive guidance and services to your clients. |

||

State Requirement Updates |

||

Stay Up-to-Date on Your State Insurance CE requirementsEasily access vital information about state insurance license renewal dates, continuing education (CE) requirements, and more by visiting our State Requirements page. Stay informed and streamline your compliance process with this valuable resource. |

||

Featured Course |

||

Retirement Planning After The SECURE 2.0 Act |

||

B.E.S.T. CE Programs |

||

Take Our Online Courses at Your Own Pace and Take Advantage of Affordable Prices |

||

|

As a nationally approved provider by the State Insurance and CFP / IWI Boards, we offer courses that cover a wide range of topics relevant to your practice. Enroll in our online CE courses and reap the benefits of:

Start learning today! Click on the button below to learn more about our online CE courses. |

||

Meet Your 2-hour CFP® Ethics RequirementAlso approved for 2 CE credit hours of IWI (CIMA®/CPWA®/RMA®) & IAR Ethics. Date: Thursday, January 18, 2024 | Time: 2:00PM - 4:00PM ET | Cost: See below* 2-hour live webinar presentation: Ethic CE CFP Boards Revised Code and Standards Ethics for CFP Professionals (Course#: 277681) - No exam required. This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. It is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct. This webinar presentation does NOT include state insurance CE credit. *Cost per license type:

Registering involves three individual web pages and you will either be automatically Registering includes the following three web pages:

NOTE: Do not close any of your web pages / browsers |

||

Start Fulfilling Your 12-hour IAR CE Requirements Online Today!Small Business Retirement Plans and Ethical Practices (split course)* Course #1: C25279 | Course #2: C25280 | Cost: see below Small businesses constitute an essential element of the U.S. economy. Approximately 30 million small businesses operate in the United States, making up the vast majority of employer firms in the country. Collectively, these small businesses employ nearly 80 million workers or approximately half of all private sector employees. This course is designed to review and clarify the diverse business structures and the benefit plans available to each. For decades, the tax law has included special rules to provide various benefits or incentives to small businesses or to exclude them from a burdensome rule. Yet, the federal tax law has no single, uniform definition of small business. Instead, as recently illustrated by the Small Business Jobs Act of 2010, such businesses may be defined based on gross receipts, assets, capital, entity type, number of shareholders or some amount of outlay, such as start-up expenditures. Even with the same base, such as gross receipts, small is defined with varying dollar amounts. Section II of the course includes the definition of ethics, specific ethics in the insurance industry, its history and regulation, unfair marketing practices and navigating ethical dilemmas. Courses only available for states that have adopted the NASAA Model Regulations. |

||

|

Online course includes:

Cost per license type:

Above listed costs include the following fees:

|

||

|

CFP®: This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNERTM, CFP®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements. IWI: Investments & Wealth Institute® (IWI) has accepted this CFP® Ethics webinar for 2 hours of CE credit towards the IWI certifications. (CIMA®, CPWA® and RMA®) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

||

Disclaimer |

||

|

Unauthorized reproductions of Advisor News Insight newsletter are strictly prohibited. However, you are permitted to forward this newsletter (in its entirety) to colleagues via email. Under no circumstances should this newsletter be posted on any website without prior written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.). Please note that this newsletter comprises information gathered from various web-based sources, and B.E.S.T. does not assert authorship of the material unless explicitly mentioned. The articles contained herein are copyrighted by their respective publishers. While we have taken measures to verify the functionality of all included links, we cannot guarantee their continuous operation, as publishers may relocate or remove content. It is important to understand that B.E.S.T. neither endorses nor assumes any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed within this newsletter belong solely to the author and do not necessarily represent the viewpoints of B.E.S.T. Readers are strongly encouraged to rely on the information provided herein ONLY AFTER conducting their independent review of its accuracy, completeness, effectiveness, and timeliness. THIS NEWSLETTER SERVES SOLELY FOR INFORMATIONAL PURPOSES AND DOES NOT CONSTITUTE INVESTMENT, TAX, ACCOUNTING, OR LEGAL ADVICE. |

||

B.E.S.T. Information / Services |

||

Comprehensive List of Online Finance and Insurance Tools & Information |

||

ResourcesAccess a robust suite of resources at your fingertips, encompassing calculators, informative websites, quick-reference guides for taxes, Social Security, and Medicare, as well as monthly newsletters and recorded webinars. Gain a wealth of knowledge and stay up-to-date with ease through our comprehensive offerings. |

||

Social Media |

||

|

||

Physical Address & Hours of Operation© 1986 - 2024 Broker Educational Sales & Training, Inc. All Rights Reserved.

|

||

Miscellaneous |

||

|

* Unsubscribe (remove from mailing list(s)). Please allow up to five (5) business days for removal. |

||

|

Ensure newsletter delivery to your inbox by adding newsletter-owner@best-ce.com to your address book. |

||