Advisor News Insight |

||

|

News • AFRs • Facts • Website • Recommended • Podcast • Tools • Requirements • Featured • CE |

||

|

||

Industry News |

||

401(k) Rollover Planning |

||

401(k) Retirement Plan Tax Notices: Federal Actions Can Help Participants Understand Their Distribution OptionsThe GAO recently released a government report that highlights how confused 401(k) participants are when they must decide what to do with their savings after leaving employment. (U.S. Government Accountability Office (GAO), 05/22/2024) |

||

402(f) Special Tax NoticeSection 402(f) of the IRC requires 401(k) plan administrators to provide participants with information about their options for managing their 401(k) plan savings before making an eligible rollover distribution. Treasury regulations require plans to provide participants with a general description of the material features of the optional forms of benefit available under the plan before the participant consent requirement is satisfied. However, the notifications that 401(k) plans must send to participants prior to an eligible rollover distribution under the IRC are not required to specifically inform participants about the option to leave their savings in their old plan. IRS Notice 2020-62 Updated “Safe-Harbor” 402(f) Model Notice Internal Revenue Service (IRS) Notice 2020-62 contains updated model rollover notices (402(f) notices) for retirement plan participants and beneficiaries receiving eligible rollover distributions from qualified retirement plans, 403(b) plans and eligible 457(b) plans maintained by governmental employers. (IRS, 2024) |

||

401(k) RolloverA new GA Report’ “401(k) Retirement Plan tax Notices: Federal Actions Can Help Participants Understand Their Distribution Options,” notes that “many people have trouble tracking their 401(k) accounts when they change jobs.” The Internal Revenue Code (IRC) requires 401(k) plans to provide a “402(f) Special Tax Notice” (often referred to as the “Rollover Notice” or “402(f) Notice”) to participants who have separated from their employer and requested a distribution from their plan. The 402(f) Notice communicates information about the tax consequences of the distribution options for their plan savings. (U.S. Government Accountability Office, 05/22/2024) |

||

Estate Planning |

||

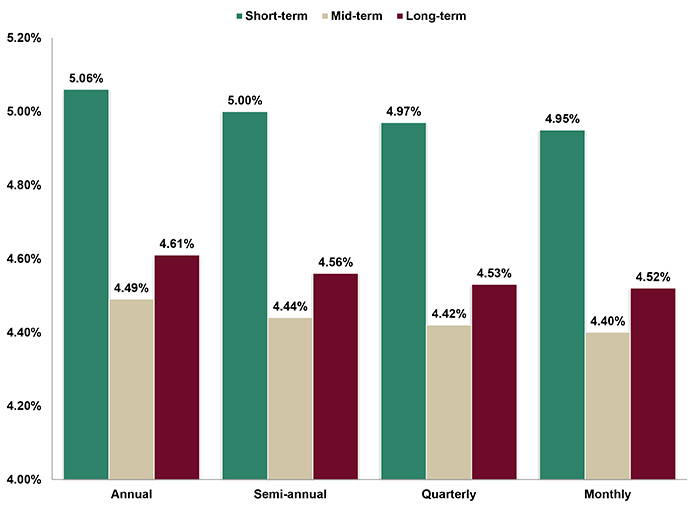

Wealth Transfer Strategies Amid Shifting Interest RatesTo best advise clients, practitioners must understand the effect of interest rates on wealth planning strategies. Given the long-term time horizon of most estate planning, this includes the effect of relevant interest rates at the time a strategy is implemented — and for many years into the future. Advisers and clients may hold differing views as to whether a given interest rate is “high” or “low,” as well as the thresholds at which such labels should be applied. (Bryan W. Bussert, CPA, MSA, The Tax Adviser, 05/01/2024) |

||

Medicare & Medicaid Planning |

||

Empowering Clients to Navigate the Medicare MazeIn an ever-evolving healthcare landscape, Medicare’s complexities present both a challenge and an opportunity for financial advisors. As clients approach retirement or face health-related decisions, they often turn to their trusted advisors for guidance on navigating the Medicare maze. Your role as a financial advisor is crucial in this process, as you are the one who can demystify Medicare for them. (Al Kushner, Leading Authority in the Medical Insurance Domain, Virtual Medicare, 06/04/2024) |

||

Retirement Planning |

||

DOL Files Counter-Brief to Retirement Security Rule ChallengeThe Department of Labor answered one of two open lawsuits in the federal courts challenging the Retirement Security Rule on June 14. The regulator’s first response in court argued that the new rule is compliant with existing case law and is substantially different from a 2016 regulation that was vacated by the U.S. 5th Circuit Court of Appeals. (Paul Mulholland, Politics and Policy Reporter, planadviser, 06/20/2024) |

||

PGIM and TIAA Rethink 4% Withdrawal Rule, Finding Retirees Can Spend MoreFor defined contribution plan participants, new research from PGIM and TIAA offers a fresh perspective on the usefulness of a standard withdrawal rule. Determining a reasonable retirement savings withdrawal rate must be personalized to an individual’s needs and circumstances, separate PGIM and TIAA data shows. The standard 4% rule is useful as a starting point, the firms’ research found. The insights are prompting the firms to develop new interactive tools that could help individuals make plans for reasonable withdrawals. (Noah Zuss, Editor, PLANSPONSOR®, 05/15/2024) PGIM Research PGIM’s data offers perspective to DC plan sponsors, advisers and participants on how to use guided spending rates. Retirement plan sponsors can support their participants, implementing tools to estimate a safe withdrawal pace above 4%, finds PGIM’s research paper “Guided Spending Rates: Rethinking ‘Safe’ Initial Withdrawal Rates.” TIAA White Paper The TIAA Annuity Paycheck Advantage shows the individuals the difference between what a first-year retiree can spend using the 4% retirement spending formula and the amount of money they could receive by converting part of their savings into TIAA guaranteed annuity at today’s interest rates. If a new retiree dedicates one-third of their savings to lifetime income through TIAA Traditional, our flagship fixed annuity, they’ll get 32% more to spend each month in their first year of retirement than if they applied only the typical, rule-of-thumb withdrawal rate. |

||

Retirement Account Statistics 2024There are $38.4 trillion in total U.S. retirement assets. Here are the key retirement statistics to know. Americans had $7.4 trillion invested in 401(k)s and $13.6 trillion in IRAs in the fourth quarter of 2023, according to the Investment Company Institute (ICI). (Dayana Yochim, Writer, and Bella Avila, Content Management Specialist, NerdWallet, 05/09/2024) |

||

The Four Pillars of a Modern Retirement Program - Why market return cash balance plans are the future of retirement... it's time for market return cash balance plans - a new generation of sustainable retirement plans that combine the best features of defined contribution (DC) and defined benefit (DB) plans. These innovative programs create guaranteed lifetime income for employees while maintaining a stable and cost-efficient path for employers to invest in employee retirement. By implementing an effective retirement program, companies are incentivizing employee loyalty and helping society. (October Three, 06/18/2024) |

||

The Generation Divide: Diving Deeper into The Financial VortexGoldman Sachs offers additional insights drawn from its annual Retirement Survey & Insights Report, which focused this year on the concept of the “financial vortex” and the way that countervailing personal and economic challenges can leave even affluent Americans struggling to make ends meet. Specifically, the supplement evaluates the distinct retirement planning challenges faced by Baby Boomers, Generation X, Millennials, and Gen Z. (Goldman Sachs, 04/23/2024) |

||

Roth IRA Planning |

||

Roth 401(k) To A Roth IRA Rollover: How Does This Work?As retirement account questions go, this is the shortest inquiry with the longest answer. When asked what factors to consider and what 5-year clocks apply with a Roth 401(k) to Roth IRA rollover, there are a number of variables to determine. Probing questions must be posed before any guidance can be given. (Andy Ives, CFP®, AIF® IRA Analyst, Ed Slott and Company, LLC, 06/05/2024) |

||

Social Security Planning |

||

Social Security’s Financial Outlook: the 2024 Update in PerspectiveA new analysis published by Alicia Munnell, the director of the Center for Retirement Research at Boston College, releases her findings of the 2024 Social Security Trustees Report. Munnell emphasizes that — despite the small improvement in the outlook – Congress still must act quickly to avoid draconian benefit cuts. (Alicia H. Munnell, Director, Center for Retirement Research at Boston College, 05/24/2024) |

||

Social Security: Selected Findings of the 2024 Annual ReportAccording to the 2024 report of the Board of Trustees of the Social Security Trust Funds, the program’s finances are in a similar, albeit marginally better, position in 2024 relative to what they were in 2023. Under intermediate assumptions, the projected combined trust fund asset depletion date is 2035 (versus 2034 in last year’s report), after which the percentage of benefits payable would be 83% (versus 80% in the 2023 report). (Social Security Administration (SSA), 05/10/2024) |

||

Practice Management |

||

Cheating for CE credits is on the riseThere has been an unusually high number of disciplinary actions filed by FINRA this year over a curious kind of advisor misconduct: Cheating to get continuing education credits. It’s not the first time the self-regulatory organization has had CE cheating reported to it, but the nearly two dozen cases so far in 2024 suggest that more brokers are taking shortcuts – or at least that they’re more frequently getting caught. (Emile Hallez, ESG editor, InvestmentNews, 06/03/2024) |

||

Assumed Federal Rates (AFRs) |

||

§7520 Rate for July is: 5.40% |

||

Financial Facts of the Month |

||

Investing for Women: What You Should KnowWhen it comes to investing, women and men differ. Here’s what the research says.Key findings

Source: The Motley Fool |

||

Useful Financial Website |

||

Board of Governors of the Federal Reserve SystemSurvey of Household Economics and DecisionmakingThe report draws from the Board’s 11th annual Survey of Household Economics and decision-making, (SHED), which examines the financial lives of U.S. adults and their families. The survey of more than 11,000 adults was conducted in October 2023. The report discusses findings related to financial well-being, income, employment, expenses, banking and credit, housing, higher education and student loans, and retirement and investments. |

||

Recommended Reading |

||

|

||

Recommended Podcast |

||

12 Podcasts for Financial AdvisorsTuning into financial podcasts can be a great way to track the latest industry trends and developments, level up your marketing game or simply learn new skills that you can use to grow your business. With so many financial advisor podcasts to choose from, it can be difficult to decide which ones are worthy of your time. To make that task easier, we’ve rounded up a list of highly-rated podcasts for advisors. The right one for you, however, will depend on where you’re at in your career or what problems you’re currently facing. |

||

Advisor Tools |

||

Free 2024 Federal Income Tax and

|

||

Financial / Insurance Calculators & WebsitesDiscover a wealth of online calculators and informational websites tailored to your needs. Our extensive resources cover essential areas such as financial planning, retirement calculations, investment analysis, and insurance needs assessment, empowering you to provide comprehensive guidance and services to your clients. |

||

State Requirement Updates |

||

Stay Up-to-Date on Your

|

||

Featured Course |

||

IAR CE Credits |

||

B.E.S.T. CE Programs |

||

Take Our Online or Self-Study Courses at

|

||

|

As a nationally approved provider by the State Insurance, CFP®, IWI, and IAR Boards, we offer courses that cover a wide range of topics relevant to your practice. Enroll in our online or self-study CE courses and reap the benefits of:

Start learning today! Click on the button below to learn more about our online or self-study CE courses. Note: California, Florida and Texas are the only states available for online CE courses. |

||

Meet Your 2-hour CFP® Ethics RequirementAlso approved for 2 CE credit hours of IWI (CIMA®/CPWA®/RMA®) and IAR Ethics. Date: Thursday, July 18, 2024 | Time: 2:00PM - 4:00PM ET | Cost: See below* 2-hour live webinar presentation: Ethic CE CFP Boards Revised Code and Standards Ethics for CFP Professionals (Course#: 277681) - No exam required. This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. It is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct. This webinar presentation does NOT include state insurance CE credit. *Cost per license type:

Registering involves

three individual web pages and you will either be

automatically directed Registering includes the following three web pages:

NOTE: Do not close any of your web pages / browsers |

||

Start Fulfilling Your 12-hour IAR

|

||

|

CFP®: This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements. IWI: Investments & Wealth Institute® (IWI) has accepted this CFP® Ethics webinar for 2 hours of CE credit towards the IWI certifications. (CIMA®, CPWA® and RMA®) NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

||

Disclaimer |

||

|

Unauthorized reproductions of Advisor News Insight newsletter are strictly prohibited. However, you are permitted to forward this newsletter (in its entirety) to colleagues via email. Under no circumstances should this newsletter be posted on any website without prior written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.). Please note that this newsletter comprises information gathered from various web-based sources, and B.E.S.T. does not assert authorship of the material unless explicitly mentioned. The articles contained herein are copyrighted by their respective publishers. While we have taken measures to verify the functionality of all included links, we cannot guarantee their continuous operation, as publishers may relocate or remove content. It is important to understand that B.E.S.T. neither endorses nor assumes any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed within this newsletter belong solely to the author and do not necessarily represent the viewpoints of B.E.S.T. Readers are strongly encouraged to rely on the information provided herein ONLY AFTER conducting their independent review of its accuracy, completeness, effectiveness, and timeliness. THIS NEWSLETTER SERVES SOLELY FOR INFORMATIONAL PURPOSES AND DOES NOT CONSTITUTE INVESTMENT, TAX, ACCOUNTING, OR LEGAL ADVICE. |

||

B.E.S.T. Information / Services |

||

B.E.S.T. CE |

||

ResourcesAccess a robust suite of resources at your fingertips, encompassing calculators, informative websites, quick-reference guides for taxes, Social Security, and Medicare, as well as monthly newsletters and recorded webinars. Gain a wealth of knowledge and stay up-to-date with ease through our comprehensive offerings. |

||

Social Media |

||

|

||

Physical Address & Hours of Operation© 1986 - 2024 Broker

Educational Sales & Training, Inc. All Rights Reserved.

|

||

MiscellaneousAbout Us | Contact Us | Privacy Notice | Refund Policy | Unsubscribe* |

||

|

*Remove from mailing list. Please allow up to five (5) business days for removal. |

||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

||