Advisor News Insight |

||

|

News • AFRs • Facts • Website • Podcast • Tools • Requirements • Featured • CE |

||

|

||

Industry News |

||

Annuity Planning |

||

Annuity Sales Up 21% in the First Quarter, LIMRA ReportsAnnuity sellers had another very strong quarter in Q1, with $113.5 billion in sales, 21% higher than the first quarter 2023. (Staff Reports, InsuranceNewsNet.com, 04/25/2024) |

||

Education Planning |

||

From College Fund to Retirement Nest Egg – Tax FreeWhen each of my children was born, I had their application for a 529 college fund filled out, mailed, and funded with the first $100 before they were released from the hospital. I dutifully funded those accounts monthly for years, until they accumulated enough to fund four years of college tuition at a South Dakota university. (Rick Kahler, MS, CFP®, CFT-I™, CeFT®, CIFSP, President of Kahler Financial Group, 05/07/2024) |

||

Elder Planning |

||

Federal Bureau of Investigation Elder Fraud Report 2023The FBI’s Internet Crime Complaint Center (or IC3) released the 2023 edition of its annual Elder Fraud Report on April 30, 2024. Elder fraud complaints to the FBI increased by 14% in 2023, and associated losses increased to $3.4 billion, an increase of 11% from 2022. (Laura Eimiller, Public Affairs Specialist, FBI Los Angeles, 05/02/2024) Elder fraud complaints to the FBI’s Internet Crime Complaint Center (or IC3) increased by 14% in 2023, and associated losses increased by about 11%, according to IC3’s 2023 Elder Fraud Report, released April 30. |

||

IRA Planning |

||

DOL Rule Brings a Trillion-Dollar Opportunity for AdvisorsThe DOL (Department of Labor) has issued new fiduciary rules for advisors that many will not like. Amazingly, it took the DOL an astounding 476 pages just to tell advisors to do right by their clients. (Ed Slott, CPA, President of Ed Slott and Company, LLC, 05/09/2024) |

||

When A Reverse Rollover Makes SenseA rollover between 401(k) funds and an IRA usually involves moving the funds from the plan to the IRA. But sometimes a “reverse rollover” – from an IRA to a 401(k) – is a smart move. (Ian Berger, JD IRA Analyst, Ed Slott and Company, LLC, 05/20/2024) |

||

Life Insurance Planning |

||

Will Your Clients’ Life Insurance Expire Before They Do?Is it a regular part of your practice to review your clients’ life insurance policies or offer a review to potential clients? Whether the review shows a need for more, less or the same amount of insurance, policy reviews represent an outstanding opportunity for you to get in front of your clients to perform a valuable service. (Robin S. Weinberger, CLU®, ChFC®, CLTC®, Director of National Accounts and Peter N. Katz, JD, CLU®, ChFC®, RICP®, Life Settlement Broker and Co-Director of National Accounts, Life Insurance Settlements Inc., 05/10/2024) |

||

Long-Term Care Planning |

||

Here’s Why Extended Care Planning Remains Critical for WomenWorking women ages 40 and up often juggle career and family obligations in a way that virtually no other demographic group does. (Wendy McCullough, Vice President, Solutions Pricing and Development, Thrivent, 04/20/2024) |

||

Retirement Planning |

||

Is Now a Good Time to Retire?This has always been a key question for clients approaching retirement, though it is less clear cut these days as many people choose to phase into retirement rather than retiring “cold turkey” as was prevalent in past generations. Most clients will rely on investments to fund a significant portion of their retirement income needs. Managing all aspects of their investments as they approach and enter retirement is a key part of the work that advisors do for these clients. (Roger Wohlner, Financial Writer, Think Advisor, 04/10/2024) |

||

Is the 4% Rule Too Safe?Nearly every financial advisor has heard of the “4% Rule,” which is based on research by Bill Bengen published in the Journal of Financial Planning in 1994. (David Blanchett, Managing Director and Head of Retirement Research, DC Solutions, PGIM DC Solutions, 05/06/2024) |

||

Retirement Planning, Longevity & Health Does It Make Sense to Plan to 95HealthView Services reports an interesting take on whether it makes sense for retirees and near-retirees to base their retirement planning under the industry-wide assumption that they will live to age 95. Instead of simply using age as a factor in determining how much to save and spend for purposes of retirement planning. (HealthView Services, 05/2024) |

||

Social Security Planning |

||

5 Social Security Claiming Options for CouplesThe ‘file and suspend’ method is no more, but spouses can still tailor their benefit strategies. One of the most important retirement decisions you and your spouse will make is when to collect Social Security benefits. As of this year, a once-popular way for married couples to make the most of that dual decision is fully off the table. (Tamara E. Holmes, Writer and Editor, AARP, 05/01/2024) |

||

Social Security Administration Finalizes Revised Regulation on Redefining Past Relevant Work for Disability Determinations by Reducing Work PeriodThe Social Security Administration has issued a rule (20 CFR Parts 404 and 416), published in the Federal Register on April 18, 2024, entitled “Intermediate Improvement to the Disability Adjudication Process, Including How We Consider Past Work.” (Targeted News Service, InsuranceNewsNet, 04/19/2024) |

||

Practice Management |

||

Do Fees, Commissions Drive bad Social Security Guidance? — Advisors’ AdviceThe retirement researchers David Blanchett and Jason Fichtner recently published an award-winning analysis about Social Security claiming, and their results quickly sparked a debate among financial advisors. Blanchett’s and Fichtner’s findings raise some uncomfortable questions about advisors’ compensation models. Specifically, their paper considers whether advisors’ focus on commissions and asset-based fees leads them to give suboptimal advice on Social Security claiming. (John Manganaro, Senior Reporter, ThinkAdvisor, 04/19/2024) |

||

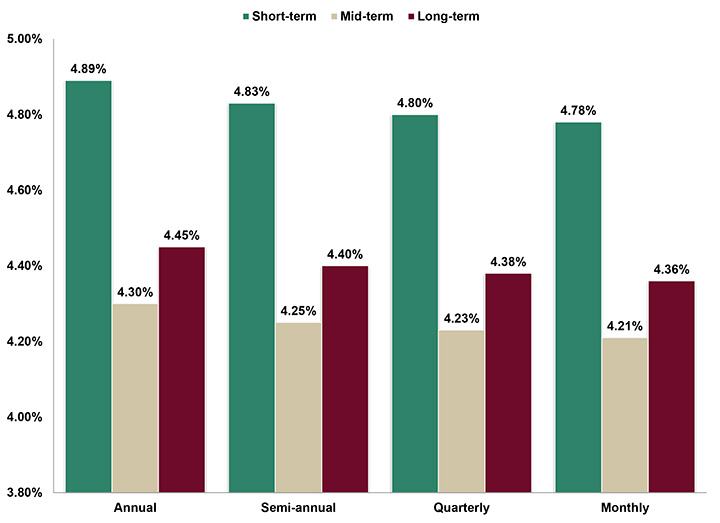

Assumed Federal Rates (AFRs) |

||

§7520 Rate for June is: 5.60% |

||

|

||

Financial Facts of the Month |

||

5 Fun Facts About Finance & InvestingWealtheon presents 5 fun facts that you may find hard to believe and would have not known otherwise. Let’s see some lesser-known “did you know” facts about finance and investing:

Source: Bloomberg | Girbaud Bastiaans | 01/03/2023 |

||

Useful Financial Website |

||

Forbes Advisor Free Online CalculatorsThese free calculators, tools and quizzes can help you navigate your health & financial journey. Use them to create a budget, figure out how much to save for retirement, find your debt-free date, improve your health, and more. |

||

Recommended Podcast |

||

|

||

Advisor Tools |

||

Free 2024 Federal Income Tax and

|

||

Financial / Insurance Calculators & WebsitesDiscover a wealth of online calculators and informational websites tailored to your needs. Our extensive resources cover essential areas such as financial planning, retirement calculations, investment analysis, and insurance needs assessment, empowering you to provide comprehensive guidance and services to your clients. |

||

State Requirement Updates |

||

Stay Up-to-Date on Your

|

||

Featured Course |

||

IAR CE Credits |

||

B.E.S.T. CE Programs |

||

Take Our Online or Self-Study Courses at

|

||

|

As a nationally approved provider by the State Insurance, CFP®, IWI, and IAR Boards, we offer courses that cover a wide range of topics relevant to your practice. Enroll in our online or self-study CE courses and reap the benefits of:

Start learning today! Click on the button below to learn more about our online or self-study CE courses. Note: California, Florida and Texas are the only states available for online CE courses. |

||

Meet Your 2-hour CFP® Ethics RequirementAlso approved for 2 CE credit hours of IWI (CIMA®/CPWA®/RMA®) and IAR Ethics. Date: Thursday, June 20, 2024 | Time: 2:00PM - 4:00PM ET | Cost: See below* 2-hour live webinar presentation: Ethic CE CFP Boards Revised Code and Standards Ethics for CFP Professionals (Course#: 277681) - No exam required. This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. It is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct. This webinar presentation does NOT include state insurance CE credit. *Cost per license type:

Registering involves

three individual web pages and you will either be

automatically directed Registering includes the following three web pages:

NOTE: Do not close any of your web pages / browsers |

||

Start Fulfilling Your 12-hour IAR

|

||

|

CFP®: This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements. IWI: Investments & Wealth Institute® (IWI) has accepted this CFP® Ethics webinar for 2 hours of CE credit towards the IWI certifications. (CIMA®, CPWA® and RMA®) NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

||

Disclaimer |

||

|

Unauthorized reproductions of Advisor News Insight newsletter are strictly prohibited. However, you are permitted to forward this newsletter (in its entirety) to colleagues via email. Under no circumstances should this newsletter be posted on any website without prior written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.). Please note that this newsletter comprises information gathered from various web-based sources, and B.E.S.T. does not assert authorship of the material unless explicitly mentioned. The articles contained herein are copyrighted by their respective publishers. While we have taken measures to verify the functionality of all included links, we cannot guarantee their continuous operation, as publishers may relocate or remove content. It is important to understand that B.E.S.T. neither endorses nor assumes any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed within this newsletter belong solely to the author and do not necessarily represent the viewpoints of B.E.S.T. Readers are strongly encouraged to rely on the information provided herein ONLY AFTER conducting their independent review of its accuracy, completeness, effectiveness, and timeliness. THIS NEWSLETTER SERVES SOLELY FOR INFORMATIONAL PURPOSES AND DOES NOT CONSTITUTE INVESTMENT, TAX, ACCOUNTING, OR LEGAL ADVICE. |

||

B.E.S.T. Information / Services |

||

B.E.S.T. CE |

||

ResourcesAccess a robust suite of resources at your fingertips, encompassing calculators, informative websites, quick-reference guides for taxes, Social Security, and Medicare, as well as monthly newsletters and recorded webinars. Gain a wealth of knowledge and stay up-to-date with ease through our comprehensive offerings. |

||

Social Media |

||

|

||

Physical Address & Hours of Operation© 1986 - 2024 Broker

Educational Sales & Training, Inc. All Rights Reserved.

|

||

MiscellaneousAbout Us | Contact Us | Privacy Notice | Refund Policy | Unsubscribe* |

||

|

*Remove from mailing list. Please allow up to five (5) business days for removal. |

||

|

Ensure newsletter delivery to your inbox by adding newsletter-owner@best-ce.com to your address book. |

||