Advisor News Insight |

||

|

News • AFRs • Recommended • Tools • Requirements • Featured • CE |

||

|

||

Industry News |

||

Charitable Planning |

||

The 2024 National Study on Donor Advised FundsThe Donor Advised Fund Research Collaborative (DAFRC) is a consortium of academic and nonprofit researchers. Working across institutions, the collaborative is leading a 30-month, comprehensive research initiative to provide empirical data and insights on the characteristics and activities of donor advised funds (DAFs) in the United States. One of the initiative's main goals is to gather and analyze account-level DAF information that is not available from publicly accessible data sources, such as the IRS Form 990. The account-level data allows for a more nuanced and accurate understanding of DAFs, as well as comparisons across different types and sizes of DAFs and DAF sponsors. (DAF Research Collaborative, 02/2024) |

||

Estate Planning |

||

A Survey of Preferences for Estate Distribution at Death Part 1: Spouses and PartnersThis is the first of two papers presenting the results of a nationally representative survey of 9,000 American adults in which we asked people how they want to distribute their property when they die. (Yair Listokin, Shibley Family Fund Professor of Law and John Morley, Professor of Law, Yale Law School, 11/7/2023) |

||

Retirement Planning |

||

The 4% Rule: ‘Neat, Plausible And Wrong’The persistent—and futile—debate over the 4% rule for retirement income brings to mind the observation of the American social critic H.L. Mencken wrote in 1920: “There is always a well-known solution to Retirement wasn’t on Mencken’s mind (the average life expectancy in 1920 was around 54). But I imagine he might have anticipated the 4% rule and the zombie economic theory that tax cuts pay for themselves. Both are neat, plausible and not obviously wrong. (Paul R. Samuelson, Chief Investment Officer and Co-Founder, LifeYield, LLC, 2/6/2024) |

||

Six Retirement Withdrawal Strategies that Stretch Savings: What’s the safe retirement withdrawal rate in 2023?For many investors, 4% sounds like the magic retirement withdrawal rate. Our research suggests the same, but fluctuating market valuations and rising inflation could threaten the security of retirement plans. In the State of Retirement Income, Morningstar researchers modeled the safe retirement drawdown rate for 2023. The report compares six retirement withdrawal strategies that can extend an investor’s retirement income. With data-driven plans, financial advisors can help clients feel secure and comfortable in the next stage of their financial lives. (Morningstar, 2023) |

||

Social Security Planning |

||

Case Study: When Should This Divorced Widow Claim Social Security BenefitsWhen and how one claims Social Security will have a profound effect on their lifetime retirement wealth. Getting the call right can result in tens or potentially even hundreds of thousands of dollars of additional lifetime benefits compared with suboptimal claiming choices. Unfortunately, there’s nothing simple about Social Security claiming. (John Manganaro, Senior Reporter, ThinkAdvisor, 01/30/2024) |

||

Tax Planning |

||

State Individual Income Tax Rates and Brackets, 2024The Tax Foundation has compiled the most up-to-date available state individual income tax rates, brackets, standard deductions, and personal exemptions for both single and joint filers. (Andrey Yushkov, Senior Policy Analyst, Tax Foundation, 02/20/2024) |

||

Practice Management |

||

The 15 Best Investment Books of All Time / Wealth ManagementWealthManagement.com recently asked readers to nominate the investment book that most helped them in their investing careers. We suggested readers pick the one book that: 1) helped crystallize their own investment strategy; and 2) the lessons of which are still relevant today. Over 250 nominations came in from many countries and every corner of the finance world. The titles included many of the most celebrated investment books, as well as some that were new to us. The books on this list are here because each received multiple votes. (WealthManagement.com, 10/16/2023) |

||

Assumed Federal Rates (AFRs) |

||

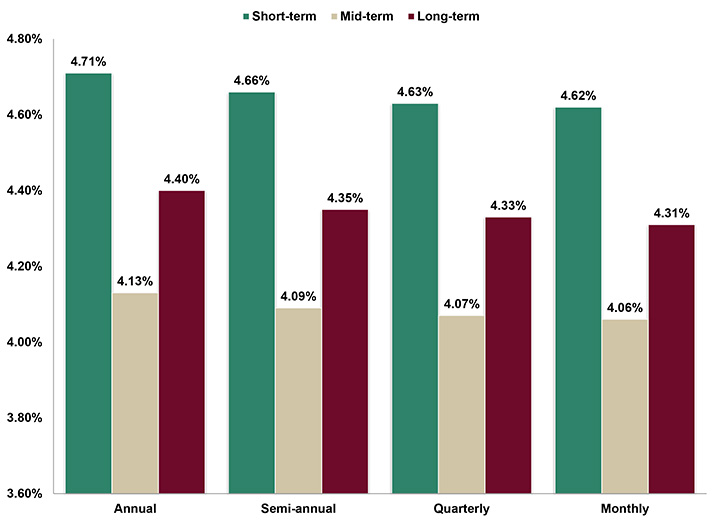

§7520 Rate for March is: 5.0% |

||

|

||

Recommended Reading |

||

|

||

Advisor Tools |

||

Free 2024 Federal Income Tax and

|

||

Financial / Insurance Calculators & WebsitesA comprehensive list of online financial and insurance tools and information.Discover a wealth of online calculators and informational websites tailored to your needs. Our extensive resources cover essential areas such as financial planning, retirement calculations, investment analysis, and insurance needs assessment, empowering you to provide comprehensive guidance and services to your clients. |

||

State Requirement Updates |

||

Stay Up-to-Date on Your

|

||

Featured Course |

||

Small Business Retirement Plans and Ethical Practices |

||

B.E.S.T. CE Programs |

||

Take Our Online Courses at Your Own Pace and

|

||

|

As a nationally approved provider by the State Insurance and CFP / IWI Boards, we offer courses that cover a wide range of topics relevant to your practice. Enroll in our online CE courses and reap the benefits of:

Start learning today! Click on the button below to learn more about our online CE courses. |

||

Meet Your 2-hour CFP® Ethics RequirementAlso approved for 2 CE credit hours of IWI (CIMA®/CPWA®/RMA®) & IAR Ethics. Date: Thursday, March 21, 2024 | Time: 2:00PM - 4:00PM ET | Cost: See below* 2-hour live webinar presentation: Ethic CE CFP Boards Revised Code and Standards Ethics for CFP Professionals (Course#: 277681) - No exam required. This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. It is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct. This webinar presentation does NOT include state insurance CE credit. *Cost per license type:

Registering involves

three individual web pages and you will either be

automatically directed Registering includes the following three web pages:

NOTE: Do not close any of your web pages / browsers |

||

Start Fulfilling Your 12-hour IAR

|

||

|

CFP®: This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements. IWI: Investments & Wealth Institute® (IWI) has accepted this CFP® Ethics webinar for 2 hours of CE credit towards the IWI certifications. (CIMA®, CPWA® and RMA®) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

||

Disclaimer |

||

|

Unauthorized reproductions of Advisor News Insight newsletter are strictly prohibited. However, you are permitted to forward this newsletter (in its entirety) to colleagues via email. Under no circumstances should this newsletter be posted on any website without prior written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.). Please note that this newsletter comprises information gathered from various web-based sources, and B.E.S.T. does not assert authorship of the material unless explicitly mentioned. The articles contained herein are copyrighted by their respective publishers. While we have taken measures to verify the functionality of all included links, we cannot guarantee their continuous operation, as publishers may relocate or remove content. It is important to understand that B.E.S.T. neither endorses nor assumes any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed within this newsletter belong solely to the author and do not necessarily represent the viewpoints of B.E.S.T. Readers are strongly encouraged to rely on the information provided herein ONLY AFTER conducting their independent review of its accuracy, completeness, effectiveness, and timeliness. THIS NEWSLETTER SERVES SOLELY FOR INFORMATIONAL PURPOSES AND DOES NOT CONSTITUTE INVESTMENT, TAX, ACCOUNTING, OR LEGAL ADVICE. |

||

B.E.S.T. Information / Services |

||

Comprehensive List of Online Finance and

|

||

ResourcesAccess a robust suite of resources at your fingertips, encompassing calculators, informative websites, quick-reference guides for taxes, Social Security, and Medicare, as well as monthly newsletters and recorded webinars. Gain a wealth of knowledge and stay up-to-date with ease through our comprehensive offerings. |

||

Social Media |

||

|

||

Physical Address & Hours of Operation© 1986 - 2024 Broker

Educational Sales & Training, Inc. All Rights Reserved.

|

||

MiscellaneousAbout Us | Contact Us | Privacy Notice | Refund Policy | Unsubscribe* |

||

|

*Remove from mailing list. Please allow up to five (5) business days for removal. |

||

|

Ensure newsletter delivery to your inbox by adding newsletter-owner@best-ce.com to your address book. |

||