Advisor News Insight |

||

|

News • AFRs • Facts • Website • Recommended • Tools • Requirements • Featured • CE |

||

|

||

Industry News |

||

Retirement Planning |

||

Breaking News! The DOL has Released the Final Retirement Security RuleThe Department of Labor’s controversial final fiduciary rule has been released, and unless delayed by legal challenges it will become effective on Sept. 23, 2024—in advance of the November presidential election. Some of the other exemptions and reporting needs will not become effective until September 2025. (John Sullivan, Chief Content Officer and Ted Godbout, Writer/Editor, American Retirement Association, 04/23/2024) Links to the final rule, related PTE amendments and a fact sheet below: |

||

‘Magic Number’ for a Comfortable Retirement Surges to $1.46 MillionAmericans’ “magic number” for a comfortable retirement has reached an all-time high at $1.46 million, rising much faster than the rate of inflation and swelling more than 50% since the pandemic began. Over a five-year period, people’s “magic number” has jumped by a whopping 53% from the $951,000 target that Americans reported in 2020. (Ayo Mseka, Reporter, InsuranceNewsNet, 04/10/2024) |

||

Estate Planning |

||

Only 26% of Americans Have an Estate PlanSeven in 10 Americans say estate planning is at least somewhat important, yet only 26% have an estate plan, according to survey results released by FreeWill, an online provider of tools for estate planning and charitable giving. Another fact from FreeWill, 70% of adults in the U.S. do not have a will. (Michael S. Fischer, Contributing Writer, ThinkAdvisor, 04/23/2024) |

||

IRA Distribution Planning |

||

IRS Waives 2024 RMDs for IRA Beneficiaries Under 10-Year RuleThe Internal Revenue Service (IRS) has waived required minimum distributions (RMDs) in 2024 for beneficiaries under the 10-year rule. The IRS made the announcement in Notice 2024-35. For the 4th year, the IRS has waived RMDs for IRA beneficiaries who were subject to RMDs under the 10-year rule. This shows how complicated these beneficiary RMD rules have become. (IRS, 04/16/2024) |

||

Life Insurance Planning |

||

One-third of Consumers Unaware of Life Insurance Tax Benefits, Says StudyNearly a third of Americans do not realize that they can save on taxes through life insurance, according to a new study by Assurance IQ. Experts suggest this can be a missed opportunity to save money, especially at a time when most consumers are looking to save. (Rayne Morgan, Content Manager, Freelance Journalist, Copywriter & Editor, 03/14/2024) |

||

Long-Term Care Planning |

||

Is Long-Term Care Too Expensive?When people refer to “dying broke,” they typically are envisioning spending their retirement nest egg on creating experiences and memories for themselves, family, and friends. They usually aren’t talking about outliving their financial resources because of long-term health care costs. (Rick Kahler, MS, CFP®, CFT-I™, CeFT®, CCIM, Founder and President of Kahler Financial Group, 04/02/2024) |

||

Social Security Planning |

||

I’m a Social Security Expert: These 5 Types of People Should Take Social Security at 62You can start receiving Social Security as soon as you turn 62 years old, but you won’t get the full amount allotted to you if you do. You’ll have to wait until you reach the full retirement age to get the maximum benefit. Depending on the year you were born, this means you’ll need to be between the ages of 66 and 67. (Angela Mae, Contributor, GOBankingRates, 03/20/2024) |

||

When Can I Collect Social Security? Retirement’s Biggest GambleMany Americans claim Social Security early, and whether you choose 62, 67 or 70, there’s big money at stake. (Tanza Loudenback, Contributor, Buy Side from WSJ, 03/26/2024) |

||

Tax Planning |

||

Fiscal Sanity to Save AmericaThe Republican Study Committee (RSC), a conservative caucus to which most House GOP members belong, released its Fiscal Year 2025 Budget proposal, “Fiscal Sanity to Save America.” It said the budget would address the federal spending problem and pay down debt so that it would “balance in seven years, cut spending by $16.7 trillion over ten years, and reduce taxes on Americans by $5.3 trillion over ten years.” Notably, the proposal called for an increase in the age at which people can claim full Social Security benefits, although it did not mention what that age would be. (RSC, 03/20/2024) |

||

Practice Management |

||

DEI Efforts Help Industry Serve Shifting Demographics, Client NeedsThe financial services industry would be well served to focus on diversity, equity and inclusion not only to bring more people into the industry, but also to serve the demographics and needs of their client base, according to industry practitioners. Representation among both women and minorities continues to disappoint many in advisory and financial services. (Danielle Walker, Senior Reporter, money management Pensions & Investments, 04/01/2024) |

||

Assumed Federal Rates (AFRs) |

||

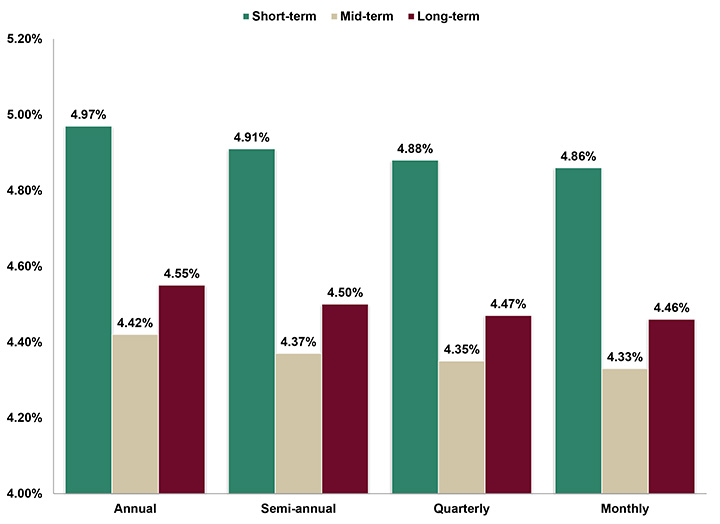

§7520 Rate for May is: 5.40% |

||

|

||

Financial Facts of the Month |

||

10 Facts for Financial Literacy MonthTo give you a better idea of the state of financial literacy in the US, here are 10 not-so-fun facts.

Source: thrivefinancialservices.com |

||

Useful Financial Website |

||

SEC’s Investor.govThe U.S. Securities and Exchange Commission enforces the laws on how investments are offered and sold to you. Protecting investors is an important part of our mission. We cannot tell you what investments to make, but this website provides unbiased information to help you evaluate your choices and protect yourself against fraud. |

||

Free Financial Planning Tools & Calculators

|

||

Recommended Reading |

||

|

||

Advisor Tools |

||

Free 2024 Federal Income Tax and

|

||

Financial / Insurance Calculators & WebsitesDiscover a wealth of online calculators and informational websites tailored to your needs. Our extensive resources cover essential areas such as financial planning, retirement calculations, investment analysis, and insurance needs assessment, empowering you to provide comprehensive guidance and services to your clients. |

||

State Requirement Updates |

||

Stay Up-to-Date on Your

|

||

Featured Course |

||

Life Insurance, Annuity and Ethical Practices |

||

B.E.S.T. CE Programs |

||

Take Our Online or Self-Study Courses at

|

||

|

As a nationally approved provider by the State Insurance, CFP®, IWI, and IAR Boards, we offer courses that cover a wide range of topics relevant to your practice. Enroll in our online or self-study CE courses and reap the benefits of:

Start learning today! Click on the button below to learn more about our online or self-study CE courses. Note: California, Florida and Texas are the only states available for online CE courses. |

||

Meet Your 2-hour CFP® Ethics RequirementAlso approved for 2 CE credit hours of IWI (CIMA®/CPWA®/RMA®) and IAR Ethics. Date: Thursday, May 30, 2024 | Time: 2:00PM - 4:00PM ET | Cost: See below* 2-hour live webinar presentation: Ethic CE CFP Boards Revised Code and Standards Ethics for CFP Professionals (Course#: 277681) - No exam required. This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. It is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct. This webinar presentation does NOT include state insurance CE credit. *Cost per license type:

Registering involves three individual web pages and you will either be

automatically directed Registering includes the following three web pages:

NOTE: Do not close any of your web pages / browsers |

||

Start Fulfilling Your 12-hour IAR

|

||

|

CFP®: This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements. IWI: Investments & Wealth Institute® (IWI) has accepted this CFP® Ethics webinar for 2 hours of CE credit towards the IWI certifications. (CIMA®, CPWA® and RMA®) NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

||

Disclaimer |

||

|

Unauthorized reproductions of Advisor News Insight newsletter are strictly prohibited. However, you are permitted to forward this newsletter (in its entirety) to colleagues via email. Under no circumstances should this newsletter be posted on any website without prior written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.). Please note that this newsletter comprises information gathered from various web-based sources, and B.E.S.T. does not assert authorship of the material unless explicitly mentioned. The articles contained herein are copyrighted by their respective publishers. While we have taken measures to verify the functionality of all included links, we cannot guarantee their continuous operation, as publishers may relocate or remove content. It is important to understand that B.E.S.T. neither endorses nor assumes any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed within this newsletter belong solely to the author and do not necessarily represent the viewpoints of B.E.S.T. Readers are strongly encouraged to rely on the information provided herein ONLY AFTER conducting their independent review of its accuracy, completeness, effectiveness, and timeliness. THIS NEWSLETTER SERVES SOLELY FOR INFORMATIONAL PURPOSES AND DOES NOT CONSTITUTE INVESTMENT, TAX, ACCOUNTING, OR LEGAL ADVICE. |

||

B.E.S.T. Information / Services |

||

B.E.S.T. CE |

||

ResourcesAccess a robust suite of resources at your fingertips, encompassing calculators, informative websites, quick-reference guides for taxes, Social Security, and Medicare, as well as monthly newsletters and recorded webinars. Gain a wealth of knowledge and stay up-to-date with ease through our comprehensive offerings. |

||

Social Media |

||

|

||

Physical Address & Hours of Operation© 1986 - 2024 Broker

Educational Sales & Training, Inc. All Rights Reserved.

|

||

MiscellaneousAbout Us | Contact Us | Privacy Notice | Refund Policy | Unsubscribe* |

||

|

*Remove from mailing list. Please allow up to five (5) business days for removal. |

||

|

Ensure newsletter delivery to your inbox by adding newsletter-owner@best-ce.com to your address book. |

||