| |

| |

|

|

| |

Annuity Planning

Should Clients Wait to Purchase an Annuity?

This article explores the trade-offs associated with the decision to delay an annuity purchase –

in particular the interaction between changes in bond yields and assumed portfolio rates of return,

and the impact of mortality improvement. After crunching some numbers, I find that the “cost”

associated with delaying an annuity purchase varies.

This article was written by David Blanchett, Ph.D., CFA, CFP®, head of Retirement Research for Morningstar’s Investment Management Group.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Charitable Planning

2020 Annual Charitable Gift Report

A new study released today by BNY Mellon Wealth Management’s Planned Giving Practice reveals that, despite concerns the

2017 Tax Cuts and Jobs Act would have a negative impact on the future of giving, philanthropists increased their support of

the non-profit sector during 2019. Non-profit organizations represented in BNY Mellon Wealth Management’s 2020 Annual

Charitable Gift Report saw an increase in planned gifts in 2019, with charitable gift annuities performing particularly well.

The number of charitable gift annuities rose 21% over the prior year and the average gift amount was up by 56%, suggesting

non-profits should consider an increased focus on marketing gift annuities.

This report was provided by BNY Mellon Wealth Management.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Estate Planning

Five Ways Corporate Trustees Can be Replaced

Many trust documents contain sufficient flexibility around management of trust assets. But what about an irrevocable trust? Can you replace a trustee?

With “advisor-friendly” approaches to trust administration, RIAs can provide investment management services for assets held in trusts.

That’s in contrast to the traditional model, in which a bank trust department has sole investment management responsibility or, at minimum, wants to custody the trust assets.

This article was written by Terry Doyle, Senior Director-Fiduciary Sales at Prairie Trust.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Health Care Planning

Medicare and You 2021

CMS has released its 2021 “Medicare and You” handbook.

|

| |

|

|

| |

|

| |

ABLE account final rules provide wide-ranging guidance

The IRS issued final regulations providing guidance to eligible individuals with a disability who

are the owners and designated beneficiaries of ABLE accounts on a wide variety of issues involving the

requirements for Sec. 529A ABLE accounts (T.D. 9923). ABLE (achieving a better life experience) accounts

are tax-favored savings accounts set up under state ABLE programs to which eligible individuals can make

contributions to meet qualified disability expenses.

This article was written by Alistair M. Nevius, J.D., Editor in Chief of Journal of Accountancy.

|

| |

|

|

| |

|

| |

A Checklist for Open Enrollment Season

One of the best aspects of full-time employment is being eligible for

employer-provided benefits: health insurance, participation in a 401(k) plan,

and so on. That’s particularly true in 2020, given that so many workers have

experienced job losses due to the coronavirus crisis and related economic downturn.

But as grateful as you may be to have access to those benefits, registering for

them can be a bit unnerving, too. The terminology may be unfamiliar unless you work

in HR, and the menu is apt to change, at least a little, from year to year. The fact

that you can typically adjust your benefits only during open enrollment season in the

last few months of the year, before coverage begins for the following year, just adds

to the unease. If you choose wrong, you’re stuck with your benefits elections until

next year. I’m sure I’m not the only one who makes benefits elections, reviews them,

and reviews them again before finally hitting “OK” and then printing out the screen

shot for good measure.

This article was written by Christine Benz, Director of Personal Finance at Morningstar.

|

| |

|

|

| |

|

| |

Can You Save Too Much in a Health Savings Account?

HSAs have generous features around withdrawals. In a worst-case scenario where

your HSA account balance exceeds your expected healthcare costs, you have two key

ways to get your money out sooner without negating the tax benefits of the HSA.

This article was written by Christine Benz, Director of Personal Finance at Morningstar.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Retirement Planning

The Seven Cases to do a Roth Conversion

Should your clients convert some of their traditional tax-deferred money (e.g. IRA or 401K) to an after-tax Roth account?

Though I’m not related to the late, eponymous Senator William Roth, I spend a significant amount of time with my clients looking

at this issue. There are some myths that are just plain wrong. Here is how to think about and frame the conversation with your clients.

This article was written by Allan S. Roth, Founder of Wealth Logic, LLC.

|

| |

|

|

| |

|

| |

3 Reasons Why You May Want to Think Twice About a 72(t) Payment Plan

Times are tough. Unemployment is high and bills are piling up for many. These realities have forced a

lot of people to look for sources of extra cash. For many Americans, their IRA is their biggest, or maybe

only, savings available. It may be tempting to consider tapping into it in these challenging times. Distributions

taken before age 59½ are subject to a 10% early distribution penalty. However, there is an exception for a series

of substantially equal periodic payments (often called “72(t) payments”). While this may seem like a good opportunity

to access IRA savings penalty-free, here are 3 reasons why you may want to think twice before you start a 72(t) payment

plan from your IRA.

This article was written by Sarah Brenner, JD,

Director of Retirement Education at Ed Slott and Company, LLC.

|

| |

|

|

| |

|

| |

IRS PLR: Decedent’s Wife May Timely Roll Over Distribution From His IRA Into Her Own IRA (IRC §408)

A surviving spouse is eligible to roll over within 60 days of receipt a distribution from her late husband’s

Individual Retirement Account, held in “Trust” as designated by him, into one or more IRAs established and maintained

in her own name and, with such timely rollover, is not required to include the amount in income for the year of such

distribution, the IRS ruled. Taxpayer, as the sole trustee and beneficiary of Trust, reserves the sole right to amend

or revoke Trust and to distribute all income and principal for her own benefit, according to the representation. [PLR 202040003]

|

| |

|

|

| |

|

| |

Projected 401k and Retirement Plan Limits for the

Tax Year 2021

The IRS hasn’t officially announced the 2021 limits yet, but based on the actual and projected CPI,

most key Internal Revenue Code limits for qualified retirement plans won't increase in 2021. Below are

our projected changes. Remember, these are unofficial projections.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Social Security Planning

2021 Social Security Changes

The SSA releases the Cost of Living adjustments for 2021.

|

| |

|

|

| |

|

| |

Social Security COLA ticks down as older adults brace for impact

More than 64 million Social Security beneficiaries will get their lowest cost-of-living adjustment in four years in 2021.

Recipients will receive a 1.3% uptick in their benefits payments in January, the Social Security Administration announced

Oct. 13. The COLA for next year is 30 basis points lower than in 2020 and less than half the amount in 2019. In another

adjustment for next year, the maximum amount of earnings subject to Social Security payroll taxes will rise to $142,800 from $137,700.

This article was written by Tobias Salinger, Senior Editor at Financial Planning.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

Tax Planning

A Quick Outline of the Biden Tax Proposals

As part of his campaign platform, Democratic Presidential nominee Joe Biden has released a

tax plan that would significantly increase taxes on high net worth individuals. Although a

campaign platform is only a “rough draft” that likely will never be fully implemented, it provides

insight into the intended direction and changes that may be coming.

This article was written by Stephanie J. Derks, Associate and Jason J. Kohout, Partner of Foley & Lardner LLP.

|

| |

|

|

| |

|

| |

IRS provides tax inflation adjustments for tax year 2021

The Internal Revenue Service announced cost of living adjustments affecting

dollar limitations for pension plans and other retirement-related items for tax

year 2021 in Notice 2020-79.

|

| |

|

|

| |

|

| |

Tax Planning by Accelerating Gain Recognition into 2020

As part of his campaign platform, Democratic Presidential nominee Joe Biden has released a

tax plan which may significantly increase the capital gain tax. Specifically, the platform

includes a proposal to eliminate the preferred 20% rate on long-term capital gain and qualified

dividends for taxpayers with more than $1 million in taxable income.

This article was written by Stephanie J. Derks, Associate and Jason J. Kohout, Partner of Foley & Lardner LLP.

|

| |

|

|

|

Top ↑

|

| |

|

|

| |

|

| |

|

|

| |

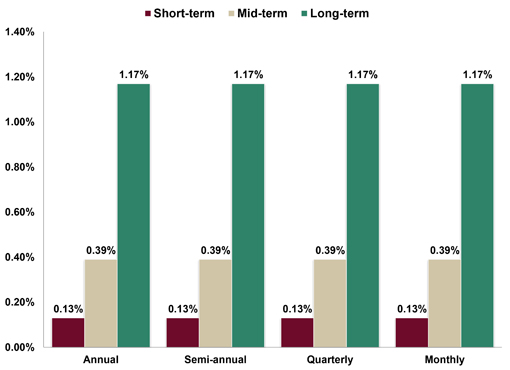

Assumed Federal Rates (AFRs)

§7520 Rate for November is: 0.4%

Breakdown:

|

| |

|

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Financial Facts of the Month

Bad Company

As of the summer 2019, there were just 4 “advanced economies” in the world with a government “debt-to-GDP” ratio higher than

the United States – Japan, Greece, Italy and Portugal. “Advanced economies” are defined as developed, industrialized and mature

economies (source: International Monetary Fund).

|

| |

|

|

| |

|

| |

Bonds

The taxable bond market was up +6.8% YTD (total return) through 9/30/20. The bond market has averaged a

gain of +7.5% per year (total return) over the last 40 years, i.e., 1980-2019. The Bloomberg Barclays Aggregate

bond index, calculated using 6,000 publicly traded government and corporate bonds with an average maturity of

5 years, was used as the bond measurement (source: BTN Research).

|

| |

|

|

| |

|

| |

Federal Deficit Hit Record $3.1 Trillion

The $3.1 trillion federal deficit for 2020, was the result of a 1.2% drop in federal revenues and a 47.3% increase in outlays.

The 2020 fiscal deficit is equivalent to 15.2% of GDP, which is the highest deficit-to-GDP ratio since 1945. It is the fifth year

in a row in which the deficit has risen as a share of GDP (source: Leimberg Information).

|

| |

|

|

| |

|

| |

It Will Take Time

Economists from the 2nd largest bank in the United States predict that the US economy will

not recover to its pre-pandemic level until early 2023 (source: Bank of America).

|

| |

|

|

|

Top ↑

|

| |

|

| |

Read All About It

Jobs in the hardcopy publishing industry (i.e., newspapers, magazines, books, directories,

mailing lists, calendars, greeting cards and maps) are projected to drop by 33% between 2019

and 2029, a forecasted loss of 99,200 jobs (source: U.S. Bureau of Labor Statistics).

|

| |

|

|

| |

|

| |

The Most Paid

The maximum Social Security benefit paid to a worker retiring at full retirement age in

2020 is $3,011 per month, triple the $975 per month maximum benefit paid 30 years

ago (source: Federal Reserve Bank of St. Louis).

|

| |

|

|

| |

|

| |

The National Debt Will Soon Exceed the Size of the Economy

The Congressional Budget Office (CBO) now expects that

the federal debt-to-GDP ratio will be 98% of GDP by the end

of this fiscal year and exceed its previous high of 106% of

GDP by the end of 2023. By 2030, they project that debt will

rise to 109% of GDP (source: CBO).

|

| |

|

|

| |

|

| |

What State is Next?

The highest marginal tax rate for state income taxes in

New Jersey in 2019 was 10.75%, effective at taxable income

levels above $5 million. On 9/24/20, state legislators

lowered the threshold when the top rate of 10.75% comes into

play to taxable incomes in excess of $1 million. The change

is expected to raise an additional $390 million per year in

state tax revenue for New Jersey (source: New Jersey

Legislature).

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Useful Financial Website

© Income Laboratory, Inc.

Income Lab is the industry’s first truly dynamic financial planning platform,

where plans are built around realistic ongoing adjustments, not simplistic static

assumptions. The platform combines deep pools of market and economic data with powerful

analytics and reality-based planning options to improve client outcomes and help

advisors differentiate and scale their businesses.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Recommended Reading |

Advanced Retirement Income Planning

Advanced Retirement Income Planning was originally written as a CE course textbook for

financial professionals. However, it is also suitable for those with some financial knowledge.

It covers the impact of luck, random (Gaussian) and fractal (non-Gaussian) market events, asset

allocation, diversification, life annuities, math of loss and sustainable withdrawal rates using

actual market history. Many worked examples are also included.

|

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Advisor Tools

|

| |

|

|

2020 Tax Guide |

|

2020 Reference Guide to Social Security

& Medicare |

Our Tax Guide contains tax information

such as: |

|

Our Reference Guide contains information

such as: |

- Individual income tax rates

- Estates and trusts tax rates

- Roth IRA contribution limits and much more

|

|

- Social Security income limits

- Medicare Parts A-D deductibles and premiums

- Medicare surtaxes and much more

|

Download the Tax Guide below: |

|

Download the Reference Guide below: |

| |

|

|

|

|

|

|

|

| |

|

| |

Financial / Insurance Calculators & Websites

An extensive list of online calculators and informational

websites.

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

Requirement Updates

Several states have updated their insurance CE

requirements. (View updates, CE requirements and more by

clicking on the link below.)

|

| |

|

|

|

Top ↑

|

| |

| |

| |

|

| |

|

|

| |

BEST Online CE Courses

At BEST we provide you with a lot of CE credit.

Courses are updated annually and are approved for State Insurance and professional

designation credits (CFP and/or CIMA/CPWA/RMA).

CE courses are:

- Cost-effective

- Nationally approved

- Specifically designed for quick completion and include:

- Self-paced courses

- Unlimited retakes of review questions and final examinations

- Instant grading

- Course material accessible for up to six (6) months from date of purchase

- Excellent customer support team

|

| |

|

|

| |

|

| |

BEST Virtual Super CE Events

We provide advisors with the maximum amount of State Insurance CE credit and 10 CE credit hours of CFP and 5 CE credit hours of CIMA/CPWA/RMA credit. Includes study material, a live webinar and an electronic exam. |

| |

|

|

| |

|

| |

CFP/CIMA/CPWA/RMA Ethics CE 2-Hour Live Webinar

“Ethical Practices for Professionals”

(CFP: Course # 248997 / CIMA/CPWA/RMA: Course #18BEST066)

Earn two (2) credit hours of CFP and/or CIMA/CPWA/RMA Ethics CE with NO EXAM!

(“Investments & Wealth Institute® has accepted this CFP Ethics webinar for 2 hours

of CE credit towards the CIMA®, CPWA® and RMA® certifications.”)

|

| |

|

|

| |

|

| |

Self-Study CE Course List

As a top-notch continuing education provider we:

- Deliver CE to financial and insurance advisors

- Offer up‑to‑date and industry pertinent CE

courses that maximize credits

- Provide ClearCert certified long-term care and

annuity training CE courses

- Supply CE courses that are approved in all 50

states and the

District of Columbia

Order CE courses toll free: 1-800-345-5669 OR

send an email to

self_study@brokered.net.

|

| |

|

|

| |

|

| |

Advisor Insight Audio Podcast

Each podcast episode gives you a quick summary of the latest industry news, updates and information.

NOTE: OUR PODCAST EPISODES ARE NOT APPROVED FOR CE CREDIT!

|

| |

|

|

|

Top ↑

|

| |

| |

| |

| |

|

|

| |

|

Reproductions of our Advisor News

Insight newsletter are prohibited unless you have received

prior authorization from Broker Educational Sales &

Training, Inc. (BEST), but you are free to email this copy

(in its entirety) to colleagues.

This newsletter may not be posted

to any website without written consent.

This newsletter is a digest of

information published by a variety of web-based sources and

is published as a service to our users. BEST is not the

author of the material unless specifically noted.

Articles are copyrighted to their

publishers. All links were tested before this newsletter was

emailed to ensure that they are still functional, but

publishers move and/or delete articles. Therefore, we cannot

guarantee that the links provided will remain operational.

BEST does not endorse and

disclaims any and all responsibility or liability for the

accuracy, content, completeness, legality, or reliability of

the material linked to in this newsletter. Reliance on this

material should only be undertaken after an independent

review of its accuracy, completeness, efficacy, and

timeliness. Opinions expressed are those of the author of

the article and do not necessarily reflect the positions of

BEST.

THIS

NEWSLETTER IS PROVIDED FOR

INFORMATIONAL PURPOSES ONLY

AND DOES NOT

CONSTITUTE INVESTMENT, TAX, ACCOUNTING OR LEGAL ADVICE.

|

|

Top ↑

|

| |