Advisor News Insight |

||||

|

News • AFRs • Website • Recommended • Tools • Requirements • Featured • CE |

||||

|

||||

Wishing you a safe and happy |

||||

Industry News |

||||

Charitable Planning |

||||

Bank of America Private Bank Study of Affluent Americans Finds Generational and Gender Divides in Charitable GivingThe vast majority (91%) of affluent Americans donate to charity, but giving motivations, priorities and strategies vary by generation and gender, according to new data from Bank of America Private Bank. (Bank of America, 10/09/2024) |

||||

Estate Planning |

||||

Assets in Great Wealth TransferBy 2030, over $30 trillion in assets will move to surviving successors, as a part of what the retirement planning industry has dubbed “the great wealth transfer.” A new study aims to help financial professionals better understand the sizable wealth shift. (Amanda Umpierrez, Managing Editor, 401(k) Specialist Magazine, 10/14/2024) |

||||

The Role of Life Insurance in Estate and Gift Tax ExemptionsWith the November election rapidly approaching, discussion about the need to grandfather the current $13.61 million federal estate and gift tax exemptions has heightened. “Use it or lose it” is the common pronouncement. But for high-net-worth individuals, are large lifetime gifts as beneficial as they may first appear? Is there any other alternative out there that can produce better overall results for the individual and their family? Yes, Life Insurance. (James G. Blase, CPA, JD, LLM, Principal , Blase and Associates, Attorneys at Law,10/01/2024) |

||||

IRA Planning |

||||

New Rules: Aggregating Year-of-Death RMDsThis article, from Ed Slott, focuses on an additional nuance of the year-of-death RMD – something created by the final regulations (released July 18, 2024) – that could make taking the year-of-death RMD a little clunky in some situations. (Andy Ives, CFP®, AIF®, IRA Analyst, Ed Slott and Company, LLC, 08/28/2024) |

||||

Medicare & Medicaid Planning |

||||

Medicare Premiums 2025: Projected IRMAA for Parts B and DProjections for Medicare’s 2025 income-related monthly adjustment amount (IRMAA) are out. This surcharge is paid by Medicare beneficiaries for Part B and Part D Medicare on top of the standard premiums if their taxable income exceeds certain thresholds. The 2025 amounts discussed in the article are not final; they are estimates prepared by financial professionals who specialize in Medicare planning and IRMAA issues. (Donna LeValley, Personal Finance Writer, Kiplinger, 10/2024) |

||||

Retirement Planning |

||||

How the Department of Labor’s New Retirement Security Rule Would End Insurance Industry Kickbacks that Cost Savers BillionsArguing that it provides evidence that supports the DOL’s currently stayed Retirement Security Rule, Sen. Elizabeth Warren has released a report concerning industry activity she suggests the rule is intended to address. The report is based on an investigation that began in April 2024, shortly after the rule was issued. According to the report, the investigation found that conflicts are pervasive in the annuity industry, third parties often facilitate these conflicts, and insurers use complicated and opaque disclosures when discussing these conflicts. (Elizabeth Warren, Senator, U.S. Senate, 09/2024) |

||||

Should You Take Your RMDs ‘In Kind’?Consider this strategy if you need to take a required minimum distribution while the stock market is down. (Christine Benz, Director of Personal Finance and Retirement Planning, Morningstar, 08/21/2024) |

||||

The New Fiduciary Rule (50): What is a Best Interest Process?The article outlines the expectations of different standard-setters regarding the development of best interest recommendations. Both the DOL and the SEC have consistent and rigorous requirements for creating these recommendations for ERISA-governed retirement plans, their participants, and IRA owners. In contrast, the National Association of Insurance Commissioners model rule is less demanding in this respect. The article elaborates on the essential requirements needed for a best-interest recommendation process. (C. Frederick Reish, Partner, Faegre Drinker, 10/28/2024) |

||||

Roth IRA Planning |

||||

Ten Important Facts About Roth IRAsThe Investment Company Institute (ICI) provides this in-depth analysis of the top ten important facts about Roth IRAs. (ICI Research, 07/2024) |

||||

Social Security Planning |

||||

Social Security COLA Raised by 2.5% for 2025The Social Security Administration has increased Social Security and Supplemental Security Income payments for 2025 by 2.5%, roughly $50 per month, in its annual cost-of-living adjustment. That boost is slightly below the average annual cost-of-living adjustment of 2.6%, the administration noted in its announcement. The most recent adjustment was 3.2% for 2024, when inflation was still at a higher level and hitting many retirees’ pocketbooks. (Alex Ortolani, Editor, planadviser®, 10/10/2024) |

||||

Social Security Fact SheetIndividual taxable earnings of up to $176,100 annually will be subject to Social Security tax in 2025, the Social Security Administration (SSA) reported. The amount, an increase from $168,600 in 2024, is the wage base limit that applies to earnings subject to the 6.2% OASDI tax (old age, survivors, and disability insurance). At or above the wage base limit, the employee and the employer each will pay $10,918.20 in tax, an increase of $465 for each party in 2025. (SSA, 09/2024) |

||||

Social Security Tells Some Online Users to Move Their AccountsSocial Security Administration website users who created online accounts before Sept. 18, 2021, will soon have to transition to a new account to maintain their access to web services, according to SSA. Specifically, the administration said, users with an account, like a my Social Security account, opened before that date will need to switch to a Login.gov account. Existing Login.gov or ID.me account holders do not need to create a new account or take any action, SSA noted. Over 5 million account holders have already transitioned to Login.gov. (Dinah Wisenberg Brin, Reporter, ThinkAdvisor, 07/12/2024) |

||||

Tax Planning |

||||

IRS Releases 2025 Inflation and Other AdjustmentsRevenue Procedure 2024-40 reveals what’s new for 2025 tax year. Some key highlights:

(IRS, 10/22/2024) |

||||

Practice Management |

||||

Fiscal Year 2025 SEC Examination Priorities Division of ExaminationsThe Securiteis and Exchange Commission has released its exam priorities for 2025—with Regulation Best Interest, Form CRS, artificial intelligence and registered investment advisor’s fiduciary duty topping the list. In addition to conducting exams in the core areas “such as disclosures and governance practices,” the agency said it will also examine for compliance “with new rules of emerging technologies, and the soundness of controls intended to protect investor information, records, and assets” in fiscal 2025. (Melanie Waddell, Senior Editor and Washington Bureau Chief, ThinkAdvisor, 10/21/2024) |

||||

What Clients Really Want From Their Advisors, According to 4 StudiesPinning down the qualities that investors really want in an advisor isn’t necessarily a straightforward task — and it’s more personal than some financial professionals may realize. It’s a “complicated picture,” Morningstar says in a new report, “What Do Investors Want From Their Advisor?” Ironically, the firm adds, that’s good news for advisors. (Dinah Wisenberg Brin, Reporter, ThinkAdvisor, 08/29/2024) |

||||

Assumed Federal Rates (AFRs) |

||||

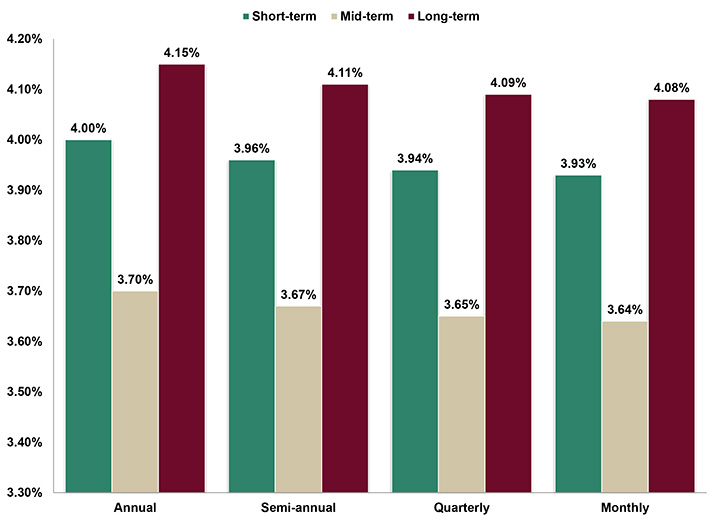

§7520 Rate for November is: 4.40% |

||||

|

||||

Useful Financial Website |

||||

|

||||

Registered Social Security Analysts, RSSA®The $139,000 Mistake Millions are Making73 million baby boomers will claim Social Security this decade. They have only one chance to get it right – yet 96% make a suboptimal choice, losing an average of $139,000 per household. This could amount to over $5 trillion in lost retirement wealth. Root cause: 2,700+ complex Social Security rules and a lack of personalized guidance. The Solution: RSSA®RSSA is the first fully integrated platform that combines technology, education, and expert guidance to optimize Social Security benefits. Our mission is to empower professionals and individuals with the tools, knowledge, and support needed to make confident, informed Social Security claiming decisions. |

||||

Recommended Reading |

||||

|

||||

covers the Medicare Advantage program and prescription drug coverage for Medicare beneficiaries, including Part D. Some of the information contained herein is derived from MedPAC’s March and June reports to the Congress; other information is unique to the Data Book. The information is presented in tables and figures with brief discussions. |

||||

Advisor Tools |

||||

Free 2024 Federal Income Tax and

|

||||

*NOTE: The 2025 guides will be available for download in next month's newsletter. |

||||

Financial / Insurance Calculators & WebsitesDiscover a wealth of online calculators and informational websites tailored to your needs. Our extensive resources cover essential areas such as financial planning, retirement calculations, investment analysis, and insurance needs assessment, empowering you to provide comprehensive guidance and services to your clients. |

||||

State Requirement Updates |

||||

Stay Up-to-Date on Your

|

||||

Featured Course |

||||

IAR CE CreditsMeet Your 12-hour IAR CE Requirements

|

||||

|

|

||||

|

||||

B.E.S.T. CE Programs |

||||

Take Our Online or Self-Study Courses at

|

||||

|

As a nationally approved provider by the State Insurance, CFP®, IWI, and IAR Boards, we offer courses that cover a wide range of topics relevant to your practice. Enroll in our online or self-study CE courses and reap the benefits of:

Start learning today! Click on the button below to learn more about our online or self-study CE courses. Note: California, Florida and Texas are the only states available for online CE courses. |

||||

Meet Your 2-hour CFP® Ethics RequirementAlso approved for 2 CE credit hours of IWI (CIMA®/CPWA®/RMA®) and IAR Ethics. Date: Thursday, November 21, 2024 | Time: 2:00PM - 4:00PM ET | Cost: See below* 2-hour live webinar presentation: Ethic CE CFP Boards Revised Code and Standards Ethics for CFP Professionals (Course#: 277681) - No exam required. This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. It is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct. This webinar presentation does NOT include state insurance CE credit. *Cost per license type:

Registering involves

three individual web pages and you will either be

automatically directed Registering includes the following three web pages:

NOTE: Do not close any of your web pages / browsers |

||||

|

CFP®: This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements. IWI: Investments & Wealth Institute® (IWI) has accepted this CFP® Ethics webinar for 2 hours of CE credit towards the IWI certifications. (CIMA®, CPWA® and RMA®) NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

||||

Are You Looking to Meet Your IAR CE Requirements? Check Out B.E.S.T.’s CE Courses.(6 CE Credit Hour Courses Also Available. See below.)At B.E.S.T, we understand the importance of staying compliant while also enhancing your professional skills. That’s why we’ve developed a comprehensive menu of continuing education (CE) programs tailored to meet these exact requirements. B.E.S.T. has created the following courses that provide all 12 hours of IAR CE credit. (6 CE credit hours of Products and Practices & 6 CE credit hours of Ethics and Professional Responsibility) 12 Credit Hour Split CE Courses

Online:

Self-Study:

6 Credit Hour Products and Practices CE Courses Online: Self-Study: 6 Credit Hour Ethics and Professional Responsibility CE Courses Online: Self-Study: 2 Credit Hour Ethics and Professional Responsibility CE Courses

NOTE: Additional fee includes IAR’s governing board filing fee of $3.00 per credit hour/per student. If you add CFP CE credits, there is also an additional CFP Board fee of $1.25 per credit hour/per student. (IAR CE credits are only available for states that have adopted the NASAA Model Regulations.) |

||||

|

NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

||||

Disclaimer |

||||

|

Unauthorized reproductions of Advisor News Insight newsletter are strictly prohibited. However, you are permitted to forward this newsletter (in its entirety) to colleagues via email. Under no circumstances should this newsletter be posted on any website without prior written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.). Please note that this newsletter comprises information gathered from various web-based sources, and B.E.S.T. does not assert authorship of the material unless explicitly mentioned. The articles contained herein are copyrighted by their respective publishers. While we have taken measures to verify the functionality of all included links, we cannot guarantee their continuous operation, as publishers may relocate or remove content. It is important to understand that B.E.S.T. neither endorses nor assumes any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed within this newsletter belong solely to the author and do not necessarily represent the viewpoints of B.E.S.T. Readers are strongly encouraged to rely on the information provided herein ONLY AFTER conducting their independent review of its accuracy, completeness, effectiveness, and timeliness. THIS NEWSLETTER SERVES SOLELY FOR INFORMATIONAL PURPOSES AND DOES NOT CONSTITUTE INVESTMENT, TAX, ACCOUNTING, OR LEGAL ADVICE. |

||||

B.E.S.T. Information / Services |

||||

B.E.S.T. CE |

||||

ResourcesAccess a robust suite of resources at your fingertips, encompassing calculators, informative websites, quick-reference guides for taxes, Social Security, and Medicare, as well as monthly newsletters and recorded webinars. Gain a wealth of knowledge and stay up-to-date with ease through our comprehensive offerings. |

||||

Social Media |

||||

|

||||

Physical Address & Hours of Operation© 1986 - 2024 Broker

Educational Sales & Training, Inc. All Rights Reserved.

|

||||

MiscellaneousAbout Us | Contact Us | Privacy Notice | Refund Policy | Unsubscribe* |

||||

|

*Remove from mailing list. Please allow up to five (5) business days for removal. |

||||

|

Ensure newsletter delivery to your inbox by adding [email protected] to your address book. |

||||