Advisor News Insight |

||

|

News • AFRs • Recommended • Podcast • Tools • Requirements • Featured • CE |

||

|

||

Industry News |

||

Charitable Planning |

||

Everyday Actions, Extraordinary Potential: The Power of Giving and VolunteeringThe Generosity Commission’s report is a rigorous analysis of generosity today. Everyday givers and volunteers have extraordinary power to meet local needs, build community, and strengthen our social fabric. As fewer people are giving to and volunteering with nonprofits today, the Generosity Commission shares research and recommendations to protect and promote the future of generosity in the United States. (The Generosity Commission, 09/2024) |

||

Estate Planning |

||

Rich Americans Prep Fail-Safe Estate Plans Ahead Of ElectionWith the presidential race in a dead heat, rich Americans are calling estate lawyers. The wealthy want to know if they should take steps to protect their fortunes from higher estate taxes. Should a change under the 2017 tax cuts expire as scheduled after 2025—considered more likely with Vice President Kamala Harris in the White House and Democrats gaining the majority in Congress—the minimum wealth subject to the estate tax would be halved to roughly $7 million per person. (Paul L. Caron, Duane and Kelly Roberts Dean Professor of Law, Caruso School of Law, Pepperdine University, Caruso School of Law, 09/17/2024) |

||

Unofficial Inflation Adjustments for 2025The Bureau of Labor Statistics has published the Chained Consumer Price Index (C-CPI-U) for August 2024, and so it’s possible to calculate various inflation adjustments for 2025. The following are the significant federal estate planning numbers calculated for 2025, with the numbers for 2024 shown in parentheses:

(Evans Law Office, 09/11/2024) |

||

IRA Planning |

||

Ed Slott: IRS’ Cure for Conflicts Could ‘Wipe Out’ IRAsThe takeaway for advisors from the just-released Government Accountability Report on IRA conflicts is that “unfortunately, more regulation is on the way and that means more burdensome compliance paperwork,” according to IRA and tax expert Ed Slott of Ed Slott & Co. (Melanie Waddell, Senior Editor and Washington Bureau Chief, ThinkAdvisor, 08/29/2024) |

||

New IRA Aggregation Rule When Doing A Rollover in an RMD YearIf you have clients with multiple traditional IRAs and they want to do a 60-day rollover (or Roth conversion) in a year when a required minimum distribution (RMD) is due, the IRS has a surprise for them. If your client has multiple IRAs and wants to do a rollover (or conversion) of one or more of their IRAs during a year when a RMD is due? The first dollars distributed out of an IRA (or plan) during an RMD year are considered to be RMDs. In addition, RMDs cannot be rolled over. But how do these rules apply if the amount you take out from an IRA is more than the RMD due from that IRA for the year? (Ian Berger, JD, IRA Analyst, Ed Slott and Company, LLC, 08/26/2024) |

||

The New Fiduciary Rule (47): Recommendations to Transfer IRAs (SEC)The stay of the effective dates of the amended fiduciary regulation and amended exemptions means that the “old” DOL fiduciary regulation (the 5-part test) and the existing exemptions continue in effect indefinitely. As a result, it is unlikely that one-time plan-to-IRA rollover recommendations will be fiduciary recommendations under ERISA or the Internal Revenue Code. However, the standards of conduct for recommendations to transfer IRAs (that is, either individual retirement accounts or individual retirement annuities) are also governed by other regulators (and may still be subject to the DOL’s “old” fiduciary definition). This article will discuss conduct standards for IRA (including qualified annuities) of the SEC, NAIC and DOL. (C. Frederick Reish, Partner, Faegre Drinker’s Benefits & Executive Compensation Practice Group, 09/09/2024) |

||

Retirement Planning |

||

2025 IRS Limits Forecast – AugustThis is an update to the Milliman 2025 IRS Limits Forecast using the U.S. Bureau of Labor Statistics (BLS) report published September 11, 2024. (Various authors, Milliman, 09/12/2024) |

||

Retirement Survey & Insights Report 2024Despite eased inflation and improved economic conditions, savers have continued to feel the pressure of increasing financial priorities. In this year’s report, we explore the impact that personalized planning and advice may provide when preparing for retirement. (Goldman Sachs, 09/2024) |

||

What’s the First RMD Year for Those Born in 1959?If your client was born in 1959, what is the first year that they must start taking required minimum distributions (RMDs)? That would seem like an easy question to answer, but because of a snafu by Congress, it isn’t quite so clear. For many years, RMDs started at age 70½. Then, in the 2019 SECURE Act, Congress postponed the RMD age to 72 for people born on or after July 1, 1949. In the 2022 SECURE 2.0 Act, Congress delayed the first RMD year even further. (Ian Berger, JD, IRA Analyst, Ed Slott and Company, LLC, 09/18/2024) |

||

Social Security Planning |

||

Does It Make Sense to File Early for Social Security and Invest in the Market?According to Mary Beth Franklin, they might, depending on the year. You might get a 30% return, or you might lose 30%. It’s only fair to compare the concept of delaying Social Security to investing in a risk-free investment like a CD [certificate of deposit] or a bank account. Over the past 10 years, you were getting 0% on that bank account, and the government’s offering you 8% a year for delaying. Now, interest rates are creeping up; as we’re having this conversation, you could get a CD for 4.5% or even 5.0%. Given that, some people might be more comfortable taking Social Security and putting the money in a CD for 5%. Yes, it’s less than the 8% you pick up by delaying. But you’ve got that bird in hand. (Christine Benz, Director of Personal Finance and Retirement Planning, Morningstar, 09/15/2024) |

||

Social Security Claiming: The Case of the High-Earning CoupleUnder this set of assumptions, the couple has as many as nine reasonable options for claiming their benefits, and the difference between the maximal and minimal projection is significant — nearly $170,000. As the authors explore, the primary factors to take into consideration depend on when the couple wants benefits to begin. In general, benefits before full retirement age will lower the monthly benefit amount, and this reduction is permanent. (John Manganaro, Senior Reporter, ThinkAdvisor, 08/27/2024) |

||

Social Security Cost of Living Adjustment Forecasted at 2.5% for 2025The Senior Citizens League projects next year’s cost of living adjustment on a day when the Consumer Price Index rose 2.5% over the last year. The Bureau of Labor Statistics reported that the Consumer Price Index rose 2.5% over the last year through August. A COLA of 2.5% would raise the average monthly benefit for retired workers by $48 to $1,968, according to the Senior Citizens League. (Remy Samuels, Reporter, planadviser, 09/11/2024) |

||

Practice Management |

||

CFA vs. CFP®: Which Do You Need?This article from SmartAsset™ provides an excellent comparison between the CFA and the CFP® certifications for individuals working in finance including financial advisors. (Derek Silva, CEPF®, Writer, SmartAsset™, 06/03/2024) |

||

Explore four opportunities to elevate advisor-client relationshipMorningstar’s 2023 Voice of the Advisor research program provides a comprehensive view of the financial advisory segment through multiple studies and surveys. The research, which included surveying 400 investors, reveals that personalization in investment strategy primarily revolves around aligning clients’ risk tolerance with their goals and needs. (Manal Ali, Author, InvestmentNews, 12/21/2023) |

||

Assumed Federal Rates (AFRs) |

||

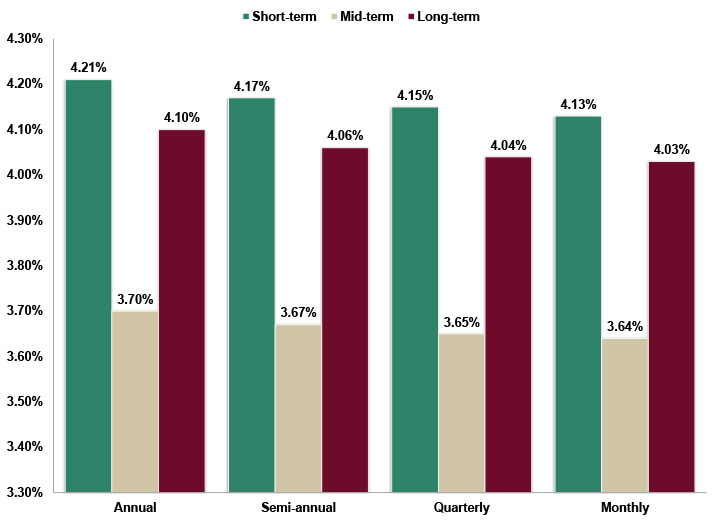

§7520 Rate for October is: 4.40% |

||

|

||

Recommended Reading |

||

|

||

Recommended Podcast |

||

The Preeminent Financial Advisor PodcastThe Value of Your Team – Episode 25.Greatness rarely, if ever, results from the efforts of just one person. As an advisor, the people you surround yourself with—your team—play an enormous role in the outcomes you’re currently enjoying (or not enjoying, as the case may be). |

||

Advisor Tools |

||

Free 2024 Federal Income Tax and

|

||

Financial / Insurance Calculators & WebsitesDiscover a wealth of online calculators and informational websites tailored to your needs. Our extensive resources cover essential areas such as financial planning, retirement calculations, investment analysis, and insurance needs assessment, empowering you to provide comprehensive guidance and services to your clients. |

||

State Requirement Updates |

||

Stay Up-to-Date on Your

|

||

Featured Course |

||

IAR CE Credits |

||

B.E.S.T. CE Programs |

||

Take Our Online or Self-Study Courses at

|

||

|

As a nationally approved provider by the State Insurance, CFP®, IWI, and IAR Boards, we offer courses that cover a wide range of topics relevant to your practice. Enroll in our online or self-study CE courses and reap the benefits of:

Start learning today! Click on the button below to learn more about our online or self-study CE courses. Note: California, Florida and Texas are the only states available for online CE courses. |

||

Meet Your 2-hour CFP® Ethics RequirementAlso approved for 2 CE credit hours of IWI (CIMA®/CPWA®/RMA®) and IAR Ethics. Date: Thursday, October 17, 2024 | Time: 2:00PM - 4:00PM ET | Cost: See below* 2-hour live webinar presentation: Ethic CE CFP Boards Revised Code and Standards Ethics for CFP Professionals (Course#: 277681) - No exam required. This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. It is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct. This webinar presentation does NOT include state insurance CE credit. *Cost per license type:

Registering involves

three individual web pages and you will either be

automatically directed Registering includes the following three web pages:

NOTE: Do not close any of your web pages / browsers |

||

Meet Your IAR CE Requirements with ONE Course Approved for ALL 12 Hours of CE CreditAt B.E.S.T, we understand the importance of staying compliant while also enhancing your professional skills. That’s why we’ve developed a comprehensive menu of continuing education (CE) programs tailored to meet these exact requirements. B.E.S.T. has created the following courses that provide all 12 hours of IAR CE credit. (6 CE credit hours of Products and Practices & 6 CE credit hours of Ethics and Professional Responsibility) 12 Credit Hour Split CE Courses

Online:

Self-Study:

6 Credit Hour Products and Practices CE Courses Online: Self-Study: 2 Credit Hour Ethics and Professional Responsibility CE Courses

NOTE: Additional fee includes IAR’s governing board filing fee of $3.00 per credit hour/per student. If you add CFP CE credits, there is also an additional CFP Board fee of $1.25 per credit hour/per student. (IAR CE credits are only available for states that have adopted the NASAA Model Regulations.) |

||

|

CFP®: This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements. IWI: Investments & Wealth Institute® (IWI) has accepted this CFP® Ethics webinar for 2 hours of CE credit towards the IWI certifications. (CIMA®, CPWA® and RMA®) NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

||

Disclaimer |

||

|

Unauthorized reproductions of Advisor News Insight newsletter are strictly prohibited. However, you are permitted to forward this newsletter (in its entirety) to colleagues via email. Under no circumstances should this newsletter be posted on any website without prior written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.). Please note that this newsletter comprises information gathered from various web-based sources, and B.E.S.T. does not assert authorship of the material unless explicitly mentioned. The articles contained herein are copyrighted by their respective publishers. While we have taken measures to verify the functionality of all included links, we cannot guarantee their continuous operation, as publishers may relocate or remove content. It is important to understand that B.E.S.T. neither endorses nor assumes any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed within this newsletter belong solely to the author and do not necessarily represent the viewpoints of B.E.S.T. Readers are strongly encouraged to rely on the information provided herein ONLY AFTER conducting their independent review of its accuracy, completeness, effectiveness, and timeliness. THIS NEWSLETTER SERVES SOLELY FOR INFORMATIONAL PURPOSES AND DOES NOT CONSTITUTE INVESTMENT, TAX, ACCOUNTING, OR LEGAL ADVICE. |

||

B.E.S.T. Information / Services |

||

B.E.S.T. CE |

||

ResourcesAccess a robust suite of resources at your fingertips, encompassing calculators, informative websites, quick-reference guides for taxes, Social Security, and Medicare, as well as monthly newsletters and recorded webinars. Gain a wealth of knowledge and stay up-to-date with ease through our comprehensive offerings. |

||

Social Media |

||

|

||

Physical Address & Hours of Operation© 1986 - 2024 Broker

Educational Sales & Training, Inc. All Rights Reserved.

|

||

MiscellaneousAbout Us | Contact Us | Privacy Notice | Refund Policy | Unsubscribe* |

||

|

*Remove from mailing list. Please allow up to five (5) business days for removal. |

||

|

Ensure newsletter delivery to your inbox by adding newsletter-owner@best-ce.com to your address book. |

||