Advisor News Insight |

||

|

News • AFRs • Facts • Links • Website • Recommended • Tools • Requirements • Featured • CE |

||

|

||

Industry News |

||

Business Planning |

||

US Supreme Court Affirms the Eighth Circuit’s Decision in Favor of the Government Concerning the Estate Tax Treatment of Life Insurance Proceeds Used to Fund a Corporate Redemption ObligationIn Connelly v. US, 602 US ___ (6/6/2024), the US Supreme Court affirmed a decision of the US Court of Appeals for the Eighth Circuit in favor of the government concerning the estate tax treatment of life insurance proceeds that are used to fund a corporate redemption obligation under a buy-sell agreement. The Supreme Court concluded that there should be no such offset. In doing so, the Supreme Court resolved a conflict that had existed among the federal circuit courts of appeal on this offset issue. (Kevin Matz, Partner, ArentFox Schiff LLP, 06/17/2024) |

||

Charitable Planning |

||

Charitable Remainder Trusts: Get Them While They Are Hot This SummerEstablishing a Charitable Remainder Trust (CRT) immediately results in an income tax deduction. All other things being equal, the higher the IRS 7520 rate, the higher the deduction. Now is a good time to take advantage of this: The 7520 rate has increased significantly in recent years but may be coming down again. The unprecedented performance of stocks like NVIDIA and Tesla over the last five years has created many new millionaires whose stock positions are highly concentrated and, therefore, risky. Upon diversification, these positions would trigger substantial capital gains taxes, but not so with a CRT. (Klaus Gottlieb, Estate Planning Attorney, Wealth Care Lawyer, 07/05/2024) |

||

Estate Planning |

||

2025: SLATs on the Brink of a Rapid Rise in Popularity?The 2010 Tax Relief Act temporarily increased the federal estate and gift tax exemption to $5 million per individual, a significant rise from prior years. As the 2012 fiscal cliff approached, concerns grew that these higher exemptions might be reduced, prompting a surge in estate planning activities. During this period, Spousal Lifetime Access Trusts (SLATs) gained popularity as estate planners promoted them as a strategic tool to lock in the increased exemption, allowing one spouse to make substantial gifts to a trust benefiting the other spouse while still retaining some access to the assets. (Klaus Gottlieb, Estate Planning Attorney, Wealth Care Lawyer, 08/25/2024) |

||

Estate Tax Exemption Clock Is Ticking Even Faster For These Wealthy ClientsClients with a substantial portion of their legacy wealth tied up in private equity investments have less than 18 months to prepare for the sunset of key provisions of the 2017 tax overhaul known as the Tax Cuts and Jobs Act — particularly the reduction of the estate tax exemption. (John Manganaro, Senior Reporter, ThinkAdvisor, 08/06/2024) |

||

The American Housing and Economic Mobility Act of 2024The American Housing and Economic Mobility Act of 2024 represents a concerted effort to tackle the housing crisis and address economic disparities through a combination of housing initiatives and tax reforms. The proposed estate tax changes, in particular, would have far-reaching implications for estate planning and wealth management in the United States. (Matthew F. Erskine, JD, Attorney and Managing Partner, Erskine & Erskine, 08/22/2024) |

||

IRA Planning |

||

A Compliant Process for Plan-to-IRA RolloversFred Reish and Joan Neri detail how RIAs can comply with current rules while the new DOL fiduciary rule remains in limbo. Question: I am a registered investment adviser who provides advisory services to individuals. I understand that the new, expansive Department of Labor fiduciary rule that would have gone into effect on September 23 is now stayed. If I recommend that an individual roll over plan monies to an individual retirement account that I manage, what process do I need to undertake to be compliant with the current rules? (Fred Reish, Partner and Joan Neri, Counsel, Faegre Drinker Biddle & Reath LLP, 08/14/2024) |

||

Understanding the ‘Multiple Trust Arrangements’ Section of the RMD Final RegsOne of the more perplexing sections of the recently issued required minimum distribution final regulations is Section 1.401(a)(9)-4(f)(4), “Multiple Trust Arrangements,” a holdover from the proposed regulations. That section provides: |

||

Life Insurance Planning |

||

An Alternative To Gifting For Estate Planning ExemptionsIn 2026, the estate and gift lifetime exemptions get cut 50% or more to less than $7 million for singles (they fall from as much as $28 million to less than $14 million for couples). That can mean much larger amounts are likely to be ensnared by a 40% estate tax, which has led to people rushing to use the exemptions before the sunset. So, what is the alternative: Life Insurance. (James G. Blase, Principal, Blase & Associates, LLC, 07/24/2024) |

||

Benefits of Iintegrating Insurance Products into a Retirement PlanA comprehensive Ernst & Young analysis of retirement savings scenarios concluded that integrating insurance products into a financial plan significantly boosts value to investors when compared with investment-only strategies. The paper by the Big Four accounting firm was undertaken in the wake of estimates predicting a $240 trillion retirement gap and a $160 trillion protection gap by 2030. The paper explores how two products can be utilized to meet investors’ savings and protection needs: Permanent life insurance (PLI), and a deferred income annuity with increasing income potential (DIA with IIP), which represents deferred income annuities with persistency bonuses and non-guaranteed dividends. (Justin Singer, EY Americas Retirement Leader Principal, Ernst & Young LLP, 01/10/2022) |

||

Social Security Planning |

||

Social Security COLA Drops to 2.6% as Inflation FallsThe Social Security cost-of-living adjustment, or COLA, for 2025 is likely to be 2.6%, based on the latest consumer price index data released August 13, 2024. The prospective COLA for next year would be about average for the last two decades and the lowest since 2021, according to an estimate provided by the independent Social Security expert Mary Johnson. (John Manganaro, Senior Reporter, ThinkAdvisor, 08/14/2024) |

||

Will Remarrying Affect My Social Security BenefitsHave you been asked this question: Will remarrying affect my Social Security benefits? Here is the correct information you can give your clients. (BJ Jarrett, Acting Deputy Associate Commissioner, SSA, 08/22/2024) |

||

Practice Management |

||

Charles Schwab Modern Wealth Survey 2024When we talk about someone being ‘wealthy’ it’s assumed to mean a significant amount of money, although it’s relative depending on our own net worth among other factors. But at what level of net worth does a cross section of Americans consider someone to be wealthy? And how does this differ from the amount required to be simply ‘comfortable’? As part of its Modern Wealth Survey, Charles Schwab has released new data revealing that most respondents think $2.5 million net worth makes someone wealthy, slightly up from the $2.2 million the study found in 2022 and 2023. (Charles Schwab & Co., Inc., 03/2024) |

||

Assumed Federal Rates (AFRs) |

||

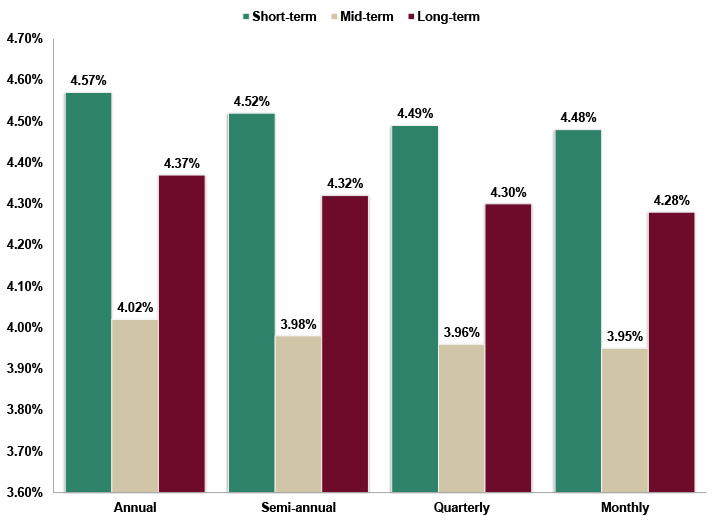

§7520 Rate for September is: 4.80% |

||

|

||

Financial Facts/Tips of the Month |

||

Easy WinGo off hoursA simple way to save on energy bills: Set appliances, such as your dishwasher or washing machine, to run early in the morning or late at night. Charging your electric vehicle at night can help too. Why? Some energy companies bill as much as 15 times more for electricity during summer “peak hours,” typically 7 a.m. to 11 p.m. Bonus reason: Dishwasher humidity can make your AC work harder. Running it at night when your AC might be pumping less can save you too. Speaking of savings, here are 7 ways to cut utility bill costs this summer. Source: Fidelity® Learning Center |

||

Informational Web Links |

||

Financial / Insurance Calculators & WebsitesDiscover a wealth of online calculators and informational websites tailored to your needs. Our extensive resources cover essential areas such as financial planning, retirement calculations, investment analysis, and insurance needs assessment, empowering you to provide comprehensive guidance and services to your clients. Site address: https://www.brokered.net/resources/calculators.php |

||

Useful Financial Website |

||

Roundup of Financial Advisor MagazinesFinancial services is an ever-changing industry and as an advisor, it’s important to stay up to date on the latest news, trends and developments. After all, your clients rely on you to have the most current information in order to make informed decisions when managing their portfolios. Reading through financial advisor magazines, either online or in print, is something you might prioritize as part of your daily round. |

||

Recommended Reading |

||

|

||

compensation arrangements. Download and Read the Report. (GAO. GAO-24-104632 Report Retirement Investments, Agencies Can Better Oversee Conflicts of Interest between Fiduciaries and Investors. Washington, D.C., GAO, 07/2024.) |

||

Advisor Tools |

||

Free 2024 Federal Income Tax and

|

||

Financial / Insurance Calculators & WebsitesDiscover a wealth of online calculators and informational websites tailored to your needs. Our extensive resources cover essential areas such as financial planning, retirement calculations, investment analysis, and insurance needs assessment, empowering you to provide comprehensive guidance and services to your clients. |

||

State Requirement Updates |

||

Stay Up-to-Date on Your

|

||

Featured Course |

||

IAR CE Credits |

||

B.E.S.T. CE Programs |

||

Take Our Online or Self-Study Courses at

|

||

|

As a nationally approved provider by the State Insurance, CFP®, IWI, and IAR Boards, we offer courses that cover a wide range of topics relevant to your practice. Enroll in our online or self-study CE courses and reap the benefits of:

Start learning today! Click on the button below to learn more about our online or self-study CE courses. Note: California, Florida and Texas are the only states available for online CE courses. |

||

Meet Your 2-hour CFP® Ethics RequirementAlso approved for 2 CE credit hours of IWI (CIMA®/CPWA®/RMA®) and IAR Ethics. Date: Tuesday, September 17, 2024 | Time: 2:00PM - 4:00PM ET | Cost: See below* 2-hour live webinar presentation: Ethic CE CFP Boards Revised Code and Standards Ethics for CFP Professionals (Course#: 277681) - No exam required. This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. It is designed to educate CFP® professionals on CFP Board’s new Code of Ethics and Standards of Conduct. This webinar presentation does NOT include state insurance CE credit. *Cost per license type:

Registering involves

three individual web pages and you will either be

automatically directed Registering includes the following three web pages:

NOTE: Do not close any of your web pages / browsers |

||

Meet Your IAR CE Requirements with ONE Course Approved for ALL 12 Hours of CE CreditAt B.E.S.T, we understand the importance of staying compliant while also enhancing your professional skills. That’s why we’ve developed a comprehensive menu of continuing education (CE) programs tailored to meet these exact requirements. B.E.S.T. has created the following courses that provide all 12 hours of IAR CE credit. (6 CE credit hours of Products and Practices & 6 CE credit hours of Ethics and Professional Responsibility) 12 Credit Hour Split CE Courses

Online:

Self-Study:

6 Credit Hour Products and Practices CE Courses Online: Self-Study: 2 Credit Hour Ethics and Professional Responsibility CE Courses

NOTE: Additional fee includes IAR’s governing board filing fee of $3.00 per credit hour/per student. If you add CFP CE credits, there is also an additional CFP Board fee of $1.25 per credit hour/per student. (IAR CE credits are only available for states that have adopted the NASAA Model Regulations.) |

||

|

CFP®: This webinar is approved by the Certified Financial Planner Board of Standards, Inc. and fulfills the requirement for CFP Board approved Ethics CE. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP®, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements. IWI: Investments & Wealth Institute® (IWI) has accepted this CFP® Ethics webinar for 2 hours of CE credit towards the IWI certifications. (CIMA®, CPWA® and RMA®) NASAA (IAR) Disclaimer: “NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.” |

||

Disclaimer |

||

|

Unauthorized reproductions of Advisor News Insight newsletter are strictly prohibited. However, you are permitted to forward this newsletter (in its entirety) to colleagues via email. Under no circumstances should this newsletter be posted on any website without prior written consent from Broker Educational Sales & Training, Inc. (B.E.S.T.). Please note that this newsletter comprises information gathered from various web-based sources, and B.E.S.T. does not assert authorship of the material unless explicitly mentioned. The articles contained herein are copyrighted by their respective publishers. While we have taken measures to verify the functionality of all included links, we cannot guarantee their continuous operation, as publishers may relocate or remove content. It is important to understand that B.E.S.T. neither endorses nor assumes any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the material linked to in this newsletter. The opinions expressed within this newsletter belong solely to the author and do not necessarily represent the viewpoints of B.E.S.T. Readers are strongly encouraged to rely on the information provided herein ONLY AFTER conducting their independent review of its accuracy, completeness, effectiveness, and timeliness. THIS NEWSLETTER SERVES SOLELY FOR INFORMATIONAL PURPOSES AND DOES NOT CONSTITUTE INVESTMENT, TAX, ACCOUNTING, OR LEGAL ADVICE. |

||

B.E.S.T. Information / Services |

||

B.E.S.T. CE |

||

ResourcesAccess a robust suite of resources at your fingertips, encompassing calculators, informative websites, quick-reference guides for taxes, Social Security, and Medicare, as well as monthly newsletters and recorded webinars. Gain a wealth of knowledge and stay up-to-date with ease through our comprehensive offerings. |

||

Social Media |

||

|

||

Physical Address & Hours of Operation© 1986 - 2024 Broker

Educational Sales & Training, Inc. All Rights Reserved.

|

||

MiscellaneousAbout Us | Contact Us | Privacy Notice | Refund Policy | Unsubscribe* |

||

|

*Remove from mailing list. Please allow up to five (5) business days for removal. |

||

|

Ensure newsletter delivery to your inbox by adding newsletter-owner@best-ce.com to your address book. |

||